In our flagship investment research advisory Innovation Investor, we spend a lot of time talking about the technological megatrends that will reshape our lives over the next few years and generate enormous economic value for their investors along the way.

We call those world-changing megatrends. And we believe investing in the best companies in them is the greatest way to generate excellent multi-year returns.

Today, however, I’d like to talk about something else — the opposite, in fact. I want to talk about a technological trend that some think is a world-changing megatrend. But it’s actually little more than a passing fad…

A “fake” megatrend, as we like to call it.

I’m referring to cannabis.

There’s this idea floating around some circles that cannabis stocks will score investors huge gains in the 2020s. They anticipate that marijuana becomes the next alcohol. And they believe brands growing cannabis will turn into the next Corona, Budweiser (BDWBY), Guinness, etc.

But that just isn’t true. In fact, it couldn’t be farther from the truth.

So, even if you’re a long-term investor, ditch pot stocks today and buy other real secular growth stocks instead.

Here’s a deeper look at why.

We Used to Be Bullish on Cannabis Stocks

Once upon a time, we were bullish on cannabis stocks, too.

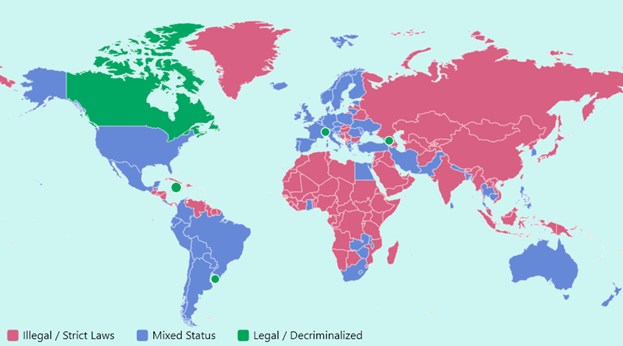

We saw the statistics that young folks like to consume marijuana as much as they like to drink alcohol. We saw the political dominoes falling one by one, with country after country legalizing pot.

We connected the dots, thinking we were entering a new world where young folks would buy tons of legal marijuana.

In fact, we believed this trend would create a $50-plus billion global cannabis industry. We expected the titans of the space would be the next Constellation Brands (STZ), Molson Coors (TAP), and Anheuser-Busch (BUD). Those are all alcoholic beverage giants worth a combined $150 billion.

But that was before. And this is now.

Now we’re actually bearish on cannabis stocks. And that bearishness comes despite us maintaining a broadly bullish outlook on legal marijuana market growth.

In other words, we still think the marijuana industry will grow significantly over the next few years. But we don’t think cannabis stocks will score investors any decent returns at all.

Why? Because growth isn’t all that matters — the quality of that growth matters, too. And cannabis stocks simply have low-quality growth prospects.

Product Commoditization, Low Margins Weigh on Long-Term Growth Prospects

Our change of heart on cannabis stocks came about after seeing the data. It underscored that even at scale, cannabis operators will forever have a tough time generating enormous profits.

You see, our initial bull thesis didn’t just hinge on the cannabis industry getting really big (and it will). It was also centered on the idea that companies like Canopy Growth (CGC) would be able to build big consumer brands. And we thought they could competitively monetize those brands at strong profit margins.

But recent trends imply that won’t happen.

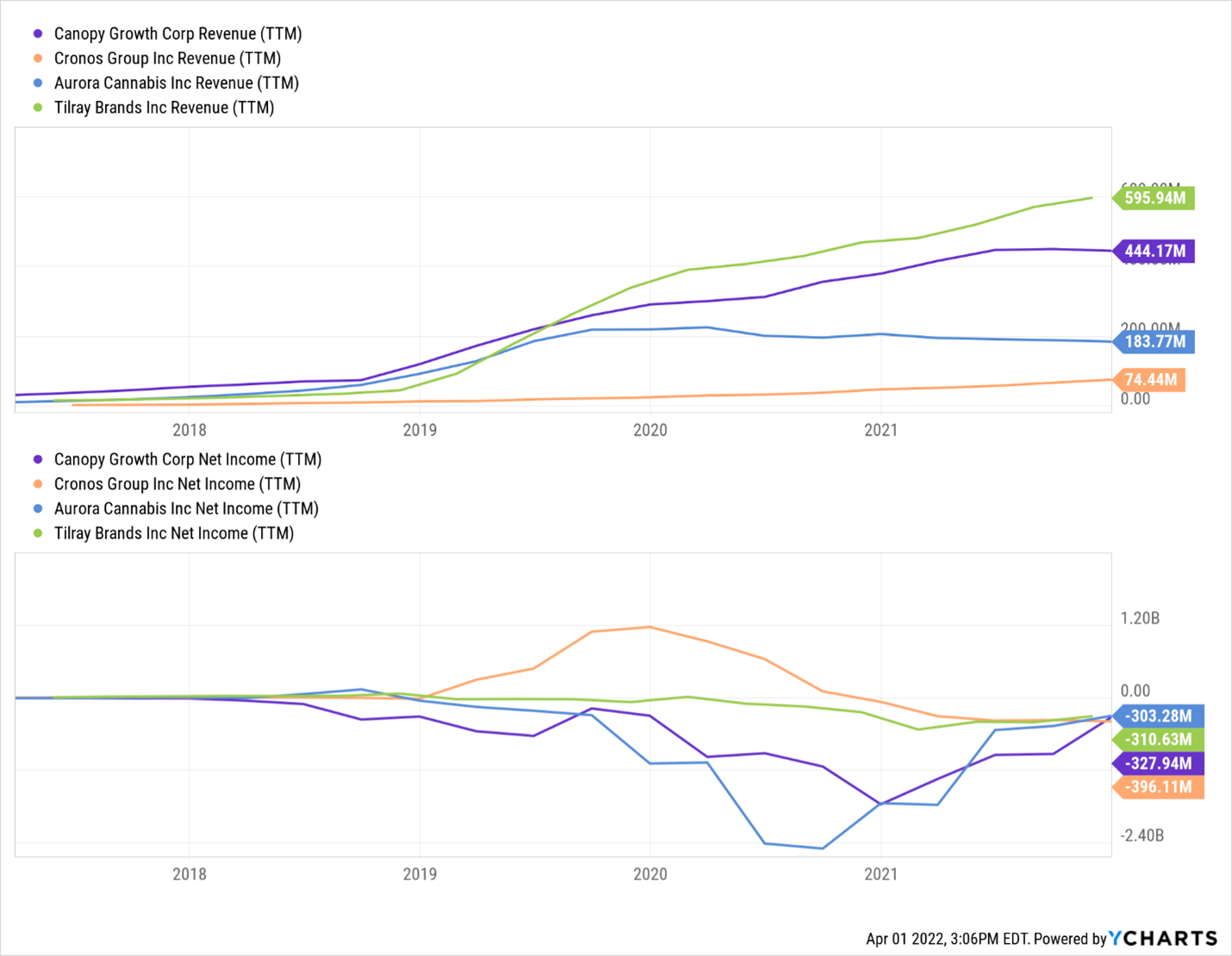

All these cannabis giants have shown disappointing earnings report after disappointing earnings report. The problem isn’t revenues. For most, revenues are surging. Instead, the problem lies with profits — or, more specifically, the lack thereof. Despite huge revenue growth, most cannabis companies have been reporting big and widening net losses.

The implication? They’re spending to grow, and they’re earning negative ROI on that spend.

In other words, these businesses don’t scale.

Why is this the case? Because the cannabis industry is entirely commoditized.

A Losing Game

As it turns out, pot is pot. Sure, there’s a difference in quality and strain. But your average consumer cannot tell that difference. And even if they can, most don’t care. Those who can tell the difference and care represent a small segment of the population. And often, they already have loyalty to a home-grown brand or their dealer down the street. They don’t have loyalty to a Canopy Growth or Aurora Cannabis (ACB).

In lieu of meaningful product differentiation and brand loyalty, these companies have to rely on price and distribution to drive competitive advantages.

That’s a losing ball game. You get into price wars where everyone loses. Spending on distribution only works until your competitor also scores the same distribution deals, in which case everything reverts to a lose-lose price war.

In a nutshell, that is why we’re bearish on cannabis stocks.

We were hopeful these companies would be able to turn supercharged demand for legal pot into huge revenues and profits. But as each quarter passes and these companies lose more and more money, it has become clear that they won’t.

Marijuana companies will forever struggle to make profits. And therefore, cannabis stocks will forever struggle to make you money.

We want to invest in early-stage companies that will be enormously profitable one day – and whose stocks will make you a ton of money as a result.

The Final Word on Cannabis Stocks

My investment strategy is simple.

I look for early-stage companies developing groundbreaking technology with the potential to fundamentally change the world. And I buy their stocks on the idea that I can make 10X-plus on my money in just a few short years.

It’s this investment strategy that helped me uncover 1,000% returns in names like Shopify (SHOP), Tesla (TSLA), NIO (NIO), Plug Power (PLUG), Roku (ROKU), Block (SQ), and more.

Unfortunately, cannabis stocks just don’t fit into that investment strategy. And that’s mostly because marijuana companies won’t ever generate enormous profits. As such, since I know I won’t make 10X my money on cannabis stocks, I don’t invest in them.

Fortunately, plenty of other stocks do fit into that investment strategy. One is a tiny next-gen auto tech firm that’s developed technology so groundbreaking that rumors are swirling that Apple (AAPL) – yes, that Apple – may soon partner with it to help build its long-awaited Apple Car.

Very few folks know about this company today. But that could change very soon. Apple is rapidly closing in on its rumored 2024 launch date for the Apple Car. And the tech giant could start making some splashy announcements any time now.

If one of those announcements contains anything about this tiny company, the stock could be off to the races.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.