Pharmaceutical firm Novavax (NASDAQ:NVAX) is getting ready to deliver vaccines for the omicron Covid-19 variant strain soon. In addition, the company just got the green light from the E.U. to start providing Covid-19 vaccines for adolescents. Consequently, there’s a strong possibility that NVAX stock will soon make a move to the upside.

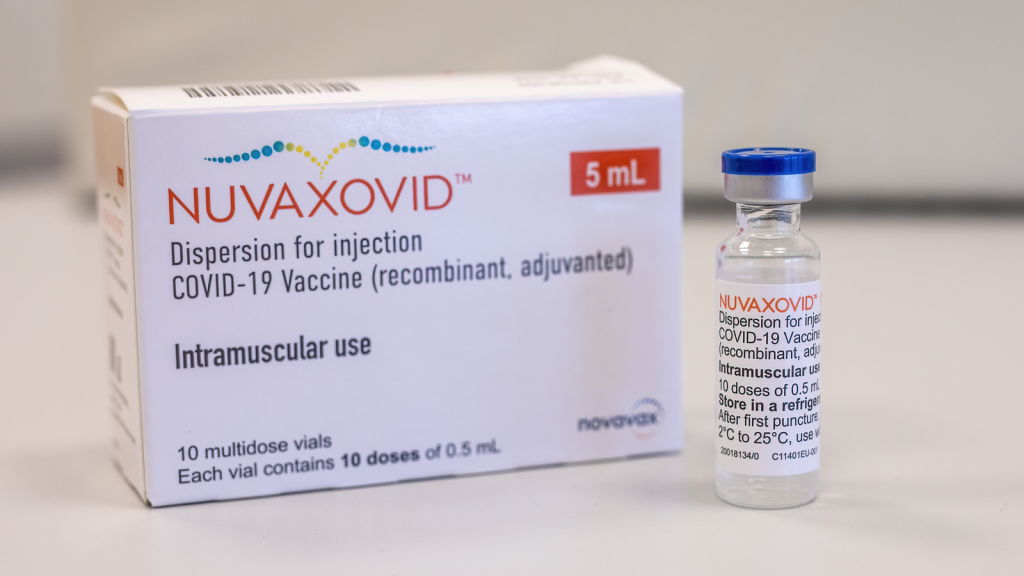

Let’s be honest, the folks on Wall Street didn’t talk much about Novavax until Covid-19 happened. The company’s stock became a target of heavy buying volume in 2020 as Novavax developed its Covid-19 vaccine, NVX-CoV2373, also sometimes known as Nuvaxovid.

Granted, NVX-CoV2373 isn’t Novavax’s only product. However, it’s fair to say that the company’s bottom line depends heavily on its Covid-19 vaccine. Therefore, investors ought to search for the latest developments concerning this disease. As it turns out, recent news items tend to favor Novavax in 2022’s second half.

| Ticker | Company | Recent Price |

| NVAX | Novavax | $69.40 |

What’s Happening With NVAX Stock?

Suffice it to say that NVAX stock holders could definitely use a shot in the arm. The stock is nowhere near its 52-week high of $277.80. In fact, it was in the $60s not long ago.

Unfortunately, Novavax doesn’t have a price-to-earnings (P/E) ratio, which means that the company isn’t profitable at the moment. Yet, as the company works diligently to combat the spread of Covid-19 in multiple countries, perhaps Novavax’s fiscal profile will improve over time.

Of course, Covid-19 can take different forms, and the public relies on vaccine makers to address the disease’s various strains. Thankfully, Novavax is highly responsive, and just recently announced an update on the company’s vaccine for the omicron variant.

Specifically, Novavax plans to provide a Covid-19 vaccine targeting omicron in this year’s fourth quarter as the company accelerates the development of vaccines to protect against the BA.4 and BA.5 sub-variants. Investors should stay tuned as Novavax expects to have additional preclinical data on omicron sub-variant shots in the late summer or fall.

Jabs for Teens

While Novavax appears to be making progress in fighting Covid-19 in the U.S., the battle is really global in scope. Hence, it’s great news that Novavax just received a crucial go-ahead in the E.U.

Notably, the European Commission has approved the expanded conditional marketing authorization of Nuvaxovid/NVX-CoV2373 in the E.U. for adolescents aged 12 through 17. Moreover, this vaccine is the first protein-based option for this age group in Europe.

While Novavax is breaking new ground here, don’t think that NVX-CoV2373 is untested in the E.U. As Novavax President and CEO Stanley C. Erck points out, “Our protein-based vaccine was developed using an innovative approach to traditional technology and has demonstrated efficacy and safety in both adolescents and adults.”

What You Can Do Now

None of the foregoing necessarily means that NVAX stock will soon return to the $200s, or that Novavax will immediately become profitable. These are long-term objectives, so investors should be patient.

In the meantime, it’s a good idea to keep tabs on Novavax’s progress in advancing its Covid-19 vaccine. As the positive news headlines reach Wall Street, don’t be surprised if the Novavax share price starts to recover. As an investor, you can prepare for this possibility by holding a few shares yourself.

On the date of publication, David Moadel did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.