Last week, the U.S government confirmed what a lot of us already presumed. We are in a technical recession. Oddly enough, it’s also confirmation of another simple but powerful fact. Now is the best time ever to buy stocks for huge, rapid gains!

Yes, I know how strange that sounds. It’s totally counterintuitive — unhinged, even. It is also entirely true and inarguable.

The more than 75 years’ worth of data we looked at shows it clearly. Investors who buy stocks immediately after a recession begins go on to make fortunes over the next year.

Therefore, history says if you buy stocks today, you’ll make a lot of money in 12 months.

It’s the opportunity of a lifetime.

Technical Recession Confirmed

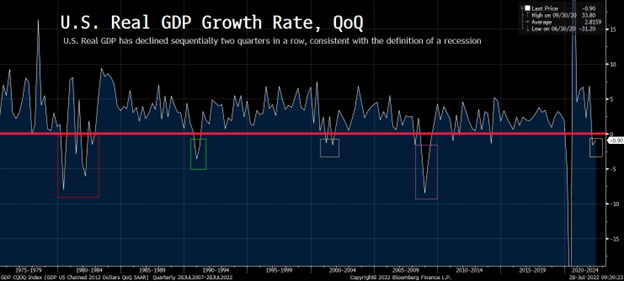

Last week, the U.S. government released its “first look” at second-quarter gross domestic product [GDP] numbers. And they were bad — bad enough to confirm that the economy is in a technical recession.

Specifically, the U.S. economy shrunk at a 0.9% annualized pace in the second quarter. That follows a 1.6% drop in economic activity in the first quarter.

The technical definition of a recession is two consecutive quarters of negative GDP growth. And that’s what we’ve seen in the first half of 2022. Therefore, the U.S. economy is technically in a recession.

Ostensibly, that seems like spooky news. Recessions mean layoffs. They mean less spending. They mean tight budgets, bankruptcies, foreclosures, and, generally speaking, tough times for all.

And strangely enough, recessions also mean higher stock prices. That’s because the stock market is a forward-looking discounting mechanism.

All About the Future

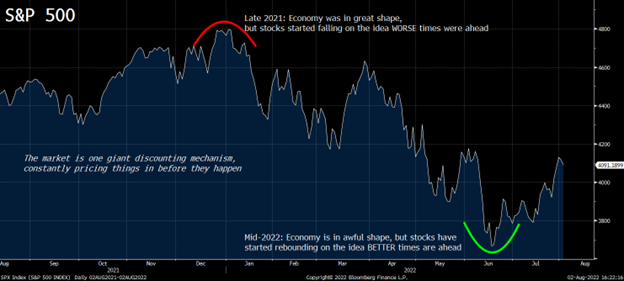

In simple terms, the stock market’s “job” is to discount against the future, pricing events into stocks before they happen.

Investors are always looking to the future. They look forward six to 12 months and price that future into stocks today. They don’t care for the present, as today’s stock prices do not reflect the current economic reality. They reflect the economic reality as it will be six to 12 months in the future.

To some degree, the stock market is the world’s best attempt at creating an economic prediction mechanism.

Let’s apply that logic to when stocks started to fall in late 2021…

With strong GDP numbers and low unemployment, the U.S. economy seemed to be on solid footing. But the market saw the writing on the wall. Six months into 2022, the economy would be in rough shape. The economic predictor kicked into gear, and equities entered a bear market.

Now let’s take that logic a step further…

Today, jobless claims are rising. Job openings are falling. That means consumer spending is falling flat, and corporate earnings growth has stalled.

Despite all that, July was the best month for the stock market since 2020.

The economic prediction mechanism is kicking back in, and the market sees brighter times ahead for the U.S. economy. It says that 2023 will see economic growth rebound as the Fed cuts rates, inflation cools, and geopolitical tensions ease.

While buying stocks amid a recession may seem counterintuitive, it’s 100% logical. The stock market is one giant discounting mechanism.

That’s exactly why buying stocks on the heels of a technical recession is a proven way to generate significant wealth in a hurry.

Technical Recession Indicator Says Stocks Can Soar 25% in a Hurry

While we’ve used the word “confirmation” a lot to reference the recession, we’re actually already at a turning point in this bear market.

How is that possible?

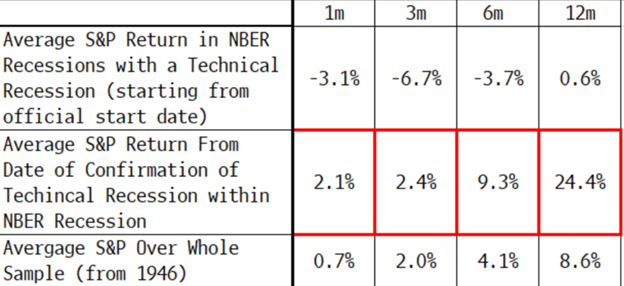

Look at it this way: A technical recession cannot be confirmed until two quarters of negative economic growth have passed. Since recessions last 14 months on average, technical confirmations tend to appear at the halfway point.

As it turns out, that halfway point is also usually the moment stocks transition from crashing to soaring.

Going back to 1947, stocks have averaged gains of nearly 25% in the 12 months following technical recession confirmations.

In other words, we have more than 75 years’ worth of data saying that after a technical recession is confirmed, stocks usually melt up by 25% over the next 12 months.

A technical recession was confirmed last week. If history repeats — or even just rhymes — then the entire market should pop over the next 12 months.

And certain high-growth stocks will jump much more than 25%. They’ll soar by 2X, 3X, or even 5X in a flash!

The Final Word

We’ve said it before, and we’ll say it again. Fortunes are made in times like these — and they’re made quickly.

Last time it happened was in 2020. That year, Tesla (TSLA) stock rose 743%. NIO (NIO) stock surged 1,103%, and Blink Charging (BLNK) rose 2,332%.

In 2009, after the financial crisis, we had a bear-to-bull-market transition. In that year, Compugen (CGEN) stock rose 1,027%. Avis Budget (CAR) soared 1,748%, and Sleep Number (SNBR) popped 2,407%.

And in 2003, after the dot-com crash, there was another bear-to-bull-market turnaround. In that year, FARO Technologies (FARO) popped 1,194%. 8×8 (EGHT) rose 1,922%, and Axon (AXON) stock surged 1,933% higher.

You get the point.

When the market enters a generational turnaround, investors are presented with a plethora of 10X investment opportunities.

If not, I highly suggest you prepare yourself.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.