Semiconductors — or chips — are everywhere. Even if we seldom see them, they essentially power our digital lives.

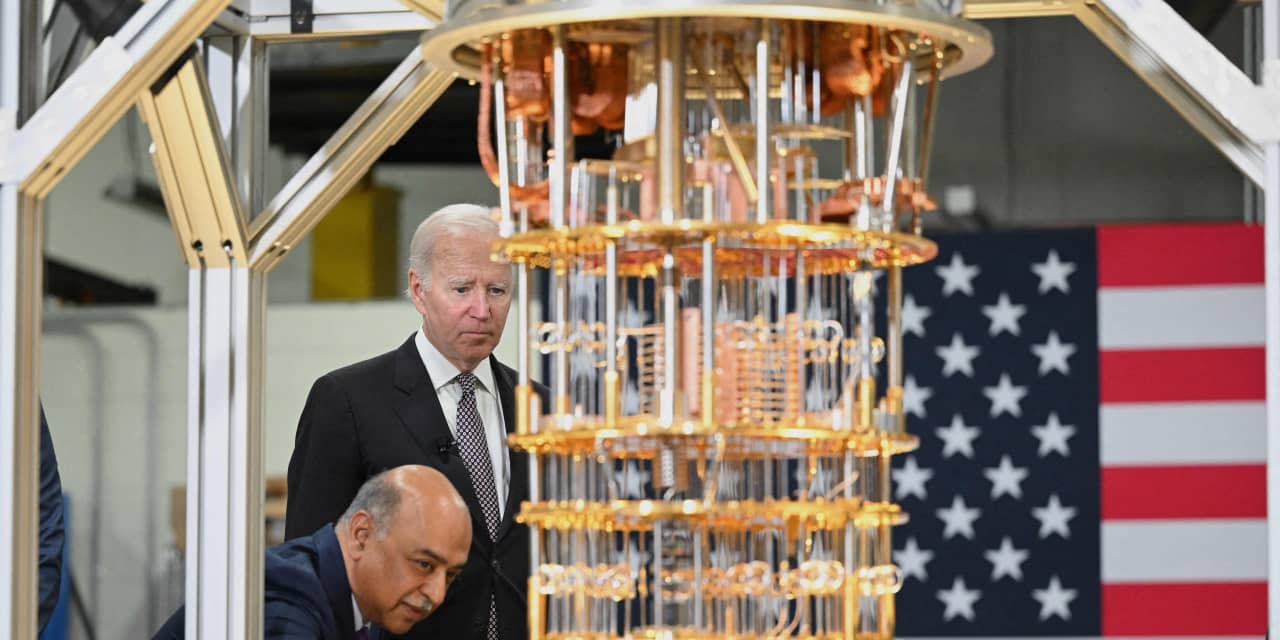

In August of this year, President Joe Biden signed the Chips and Science Act into law. The legislation, which was approved with significant bipartisan support, allocates $52.7 billion in subsidies to the semiconductor — or chip — industry.

The legislation also includes $24 billion in tax incentives and other provisions, as well as nearly $170 billion for technology research and development.

It’s been called the most significant investment in industrial policy that the United States has made in at least 50 years, but why is the federal government spending all this money on semiconductors?

Semiconductors are devices that are generally made out of silicon and are designed to turn electrical currents on and off to give some kind of control signal to a machine like a phone or laptop.

The Chips and Science Act aims to grow domestic production of digital logic and memory chips in large part by subsidizing the construction of the advanced fabrication facilities or Fabs, which are the factories where these chips are made.

And while the contemporary effort to support this industry in the United States with the Chips and Science Act is new, the country was once a leader in semiconductor manufacturing.

“We’ve always been a tremendous source of new technologies, new materials, new processes, new devices, new circuits, new systems,” professor of electrical engineering at Arizona State University Michael Kozicki said on this week’s episode of the Best New Ideas in Money podcast. “But the manufacturing… began to slip away from us to places where labor was cheaper and there were other ways of saving costs and transitioning away from manufacturing, we began to lose our grip on the semiconductor industry.”

Now Taiwan is the leader in advanced logic chip manufacturing, with one company — Taiwan Semiconductor Manufacturing Company — as the dominant manufacturer.

“It’s an industry that is driven by advances in technology, which lead to better products that lead to more markets and larger markets, that lead to more money,” Kozicki said on the podcast. “And then that money gets put into advanced products, which lead to, again, it just goes round and round and round. But if you are not on the leading edge of … the actual processes used to create the chips, you drop out that loop, that economic engine.”

Willy Shih, a professor of management practice at the Harvard Business School, said on the podcast that there are real economic and commercial reasons why making chips at home is a worthy goal.

“It is very important for the U.S. to be able to manufacture the most advanced chips because with that capability comes the ability to innovate in the future,” he said on the podcast.

While the legislation ultimately passed with significant bipartisan support, the bill wasn’t without its critics, including Independent Senator Bernie Sanders of Vermont and Republican Senator Rick Scott of Florida. They argue that it’s a massive giveaway to profitable corporations who are in no need of a helping hand. And it remains an open question, is investing billions of dollars in bringing advanced manufacturing to the U.S. a best new idea in money?

Learn more in this week’s podcast. And tune in every week to MarketWatch’s Best New Ideas in Money podcast with Stephanie Kelton, economist and a professor of economics and public policy at Stony Brook University, and MarketWatch reporter Charles Passy. Each week, they explore innovations in economics, finance, technology and policy that rethink the way we live, work, spend, save and invest.