Companies that rate publicly traded stocks based on environmental, social and governance scores will come under heightened scrutiny if Republicans are able to take over Congress in the upcoming elections.

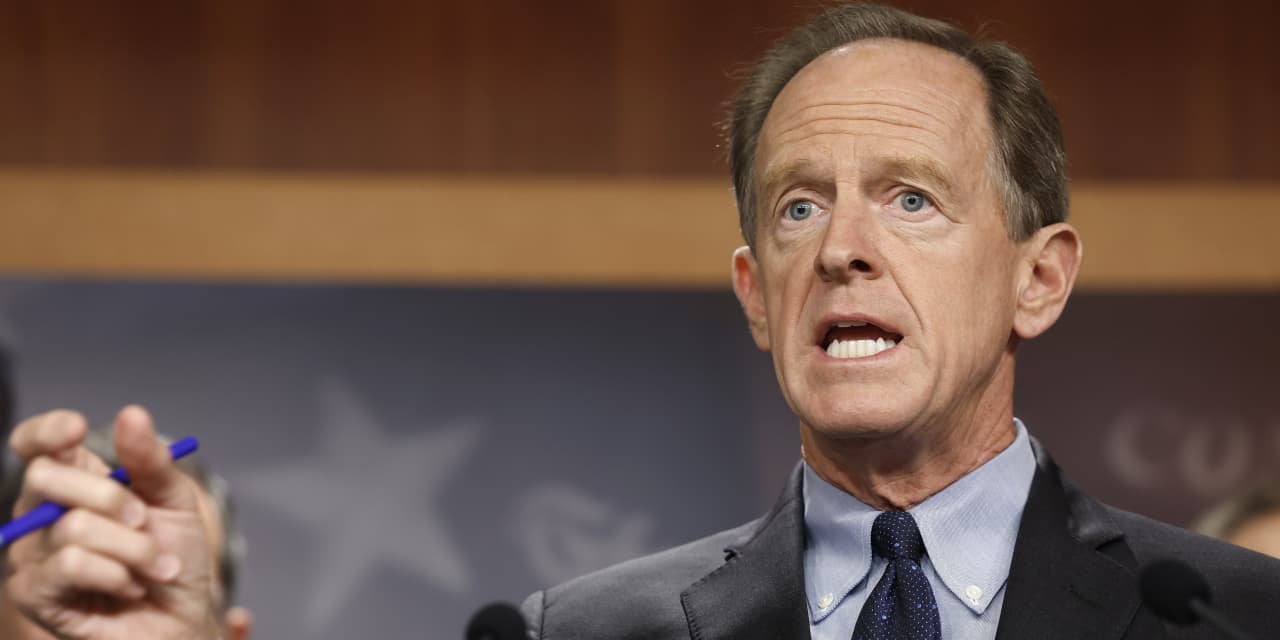

Republican Sen. Pat Toomey of Pennsylvania announced Thursday that he has requested information from 12 companies about how they calculate ESG scores, and said that six of the 12 — ESG Book, CDP, FactSet

FDS,

ISS, RepRisk, and Morningstar

MORN,

subsidiary Sustainalytics — “have either ignored the letters or have provided incomplete responses,” according to a news release, which also accused these companies of “stonewalling” Toomey’s inquiry.

FactSet declined to comment on the letter, while an ISS spokesperson said that “We’ve responded transparently to Sen. Toomey’s prior request and will continue to engage transparently with the Senator and his staff.”

An ESG spokesperson told MarketWatch the company plans to respond to the information request.

CDP said that Toomey’s letter mischaracterizes its organization as a ratings agency when in fact it is a non-profit.

“We conveyed this to Senator Toomey via email on September 26, and offered to speak with his office as subject matter experts on data disclosure to explain the transverse risk of climate, as well as the stark difference between CDP and ratings agencies,” Elizabeth Small , general counsel and head of policy for CDP North America, told MarketWatch. “The senator has not accepted our invitation – which remains open.”

These firms “play a key role in the sustainable finance industry by providing third-party data and ratings on companies to investors,” Toomey wrote in an Oct. 31 letter to the companies. “However, legitimate bipartisan concerns have also been raised regarding the veracity of third-party data, the opacity of rating methodologies, the processes by which ratings firms engage with rated entities and the management of conflicts of interest.”

Toomey sent his first letters on the topic on Sept. 20, including questions related to compliance burdens on rated entities, data veracity, ratings approaches regarding controversial political issues and conflicts of interest. Toomey sent a follow up letter to the six aforementioned organizations earlier this week.

The inquiry dovetails with broader Republican skepticism of the ESG movement in investings, with ESG assets under management globally expected to grow to $33.9 trillion in 2026 from $18.4 trillion last year, according to a recent PwC estimate.

Toomey and other Republicans have been critical of the ESG paradigm of late, arguing that it is being used by liberal activists to push corporate leaders to implement social goals related to the environment, workers rights and racial and gender equality.

At a September hearing, Toomey criticised the CEOs of America’s largest banks for caving to activist pressure related to the financing of fossil fuel extraction, arguing that banks are increasingly “using their balance sheets and influence to address issues wholly unrelated to banking, such as global warming, gun control, voters rights, and abortion.”

Rep. Andy Barr of Kentucky, a Republican on the House Financial Services Committee, told the Washington Post Wednesday that “ESG investing is a cancer within our capital markets” and a “fraud on American investors,” promising to investigate the SEC’s recent efforts to beef up disclosures related to climate risk.