If there’s one thing we learn in a market crash, it’s that no company is too big to fail. The financial crisis of 2008 had plenty of memorable examples, from Lehman Brothers to Circuit City.

But one other legacy of 2008 is that too many investors fixate on “bull markets” and “bear markets” in stocks…

Even within a bull market, specific groups of stocks are in a bear market (and vice versa). In other words, there doesn’t need to be a global financial meltdown for companies to be wiped out.

Remember Borders Books? In 2010, that mammoth organization employed over 19,000 people and operated more than 680 stores. By 2011, it was gone. Its main competitor, Barnes & Noble (BKS), is in hot water now, too.

Or Blockbuster Video? Which went belly-up in 2010, after Netflix (NFLX) revolutionized the movie rental game.

Or what about Radio Shack? In 96 years, it managed to evolve from a maritime radio supplier to a mail-order electronics business to a thriving retail operation, but finally had to close its doors in 2017.

These companies were once on the tips of every consumer’s tongue…but your great-grandkids probably won’t even know their names. It’ll be like they never existed.

So which industry is the next to be disrupted? Which company is about to vanish from the face of the earth? Will it be another retailer? How about a tech company? Or an investment bank?

It’s crucial to be able to answer these questions and make sure it’s not lurking in YOUR portfolio as we speak.

Here’s the good news:

While it often feels like these companies disappear overnight, the truth is, there are warning signs. Big, flashing, neon warning signs — if you know where to look. Once I share my list of 27 Crumbling Giants You Must Sell Now, you’ll be able to spot those warning signs instantly.

Besides their names, ticker symbols and other basic information, I’ll be sharing each stock’s Report Card from Portfolio Grader. The proprietary stock-rating system behind my Portfolio Grader is responsible for all of my big wins, including:

- 487% in Vipshop Holdings in 2014

- 274% in NVIDIA in 2019

- 433% in Big 5 Sporting Goods Corporation in 2021

- 225% in Ultra Clean Holdings in 2021

- 347% in America Movil in 2008

- 320% in Daqo New Energy Corporation in 2022

- 612% in Santarus in 2013

And now, on the flip side, these 27 stocks are sending a clear signal: “SELL NOW.” That’s what I recommend you do, if you’ve got them — or, if not, then continue to avoid them.

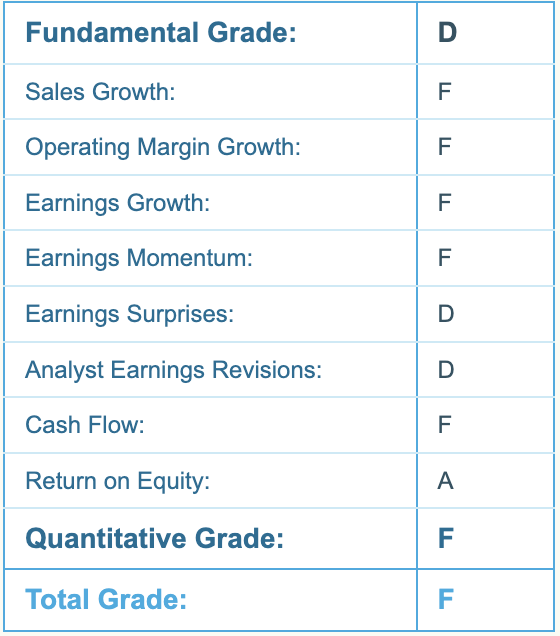

Here’s a quick rundown of the crucial factors you’ll see assessed for each stock, in its Portfolio Grader Report Card. It’s a simple, yet highly effective way to determine whether any investment is worth your time (and money!).

Glossary: The Factors That Make or Break a Stock

- Sales Growth:The percent change in a company’s sales this quarter versus the same quarter last year. Companies that show increasing sales at a very high rate are among the best candidates to become big winners over time. If a company can continually increase sales over long periods of time, then it would seem to indicate that they have a product or service that is very much in demand.

I look for companies that show year-over-year sales growth of 20% or more.

- Operating Margin Growth:The profits left after direct costs such as salary and overhead are subtracted. I then look at whether this percentage margin is contracting or growing year-over-year. A company’s operating margin will increase when its product is in such high demand that the company can continue to raise prices for the product or service without an offsetting increase in costs.

- Earnings Growth:The percent increase in a company’s earnings per share (EPS) this quarter versus the same quarter last year. EPS is just the company’s earnings divided by the number of shares they have outstanding.

Naturally, companies that are continually growing earnings year-over-year get a higher score than those that aren’t.

- Earnings Momentum:How rapidly a company’s earnings have been accelerating over the past four quarters.

Companies that are accelerating and growing earnings faster year-over-year are stronger candidates for my Buy Lists than those where earnings are slowing.

- Earnings Surprises:A company’s ability to exceed the consensus earnings estimate among Wall Street analysts. Here I am looking for stocks that can exceed what Wall Street believes they can achieve.

Stocks that deliver positive surprises for several successive quarterly earnings periods often go on to become growth stock megastars.

- Analyst Earnings Revisions:The magnitude in which earnings projections have increased over the past month. When an estimate is raised, it has tremendous positive implications for a company and its stock. If the expectation is up, then the stock should be worth more—and rise in price to reflect that fact.

- Cash Flow:The money the company has left after paying the cost of doing business and the upkeep and the maintenance needed to stay in business (relative to its total market value). In simple accounting terms, free cash equals operating earnings minus the capital expenditures needed to run the business.

- Return on Equity:A company’s profitability in terms of profits made from the money shareholders have invested. It is calculated by dividing the earnings per share by the equity (book value) per share. The higher the number, the more profitable a company is and the higher return management is providing to shareholders.

Companies that are dominant in their industry tend to earn very large returns on the equity invested.

Imagine this system like a door lock. There are 8 “key pins” inside, and the right key will push all 8 of them upwards…unlocking the door!

But if you insert the wrong key, the 8 pins won’t align correctly, and you’ll never get where you want to go.

That’s why when a stock DOES meet the above criteria, it becomes an urgent buy. And when it fails on these points, well…look out below.

This is especially true with the final factor Portfolio Grader assesses. It uses my own “secret sauce” to measure buying pressure. Think of this as “following the money.” The more money that floods into a stock, the more momentum a stock has to rise. And there’s no doubt about it, we all like stocks that rise! I use a proprietary indicator to determine this, and it generates the stock’s Quantitative Score.

Now let’s take a look at this in action:

27 Crumbling Giants You Must Sell Now

Listed alphabetically by ticker symbol for ease of reference.

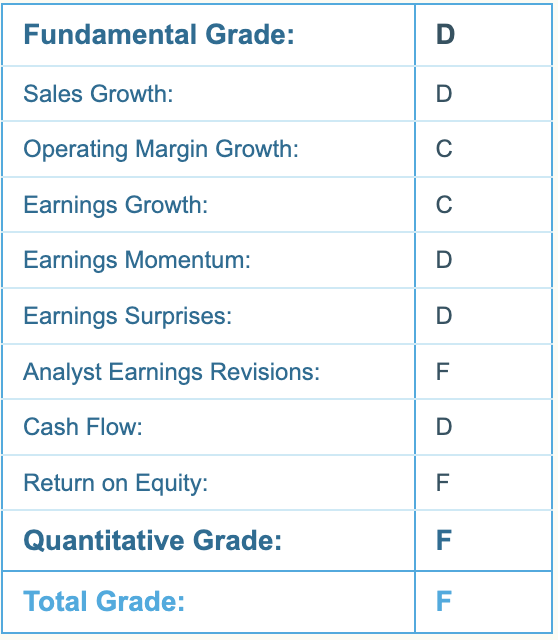

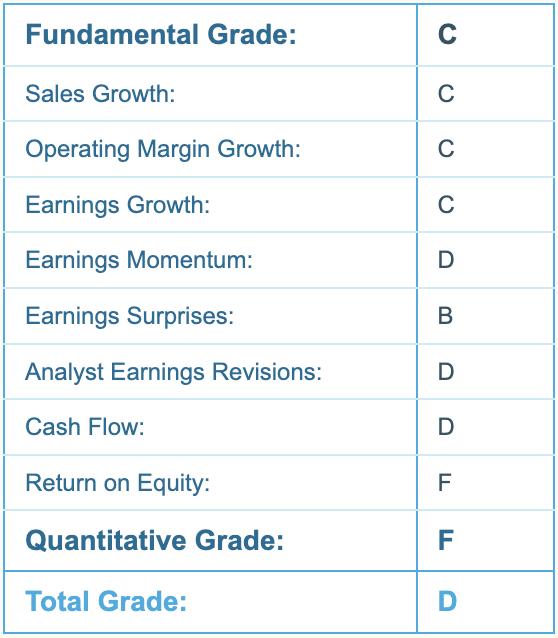

Crumbling Giant #1: American Eagle Outfitters, Inc. (AEO)

Country: United States

Industry: Apparel Retail

Market Cap: $2.1 billion

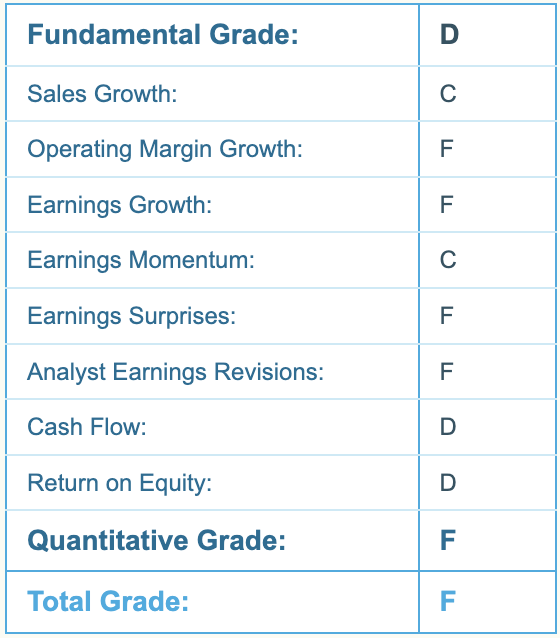

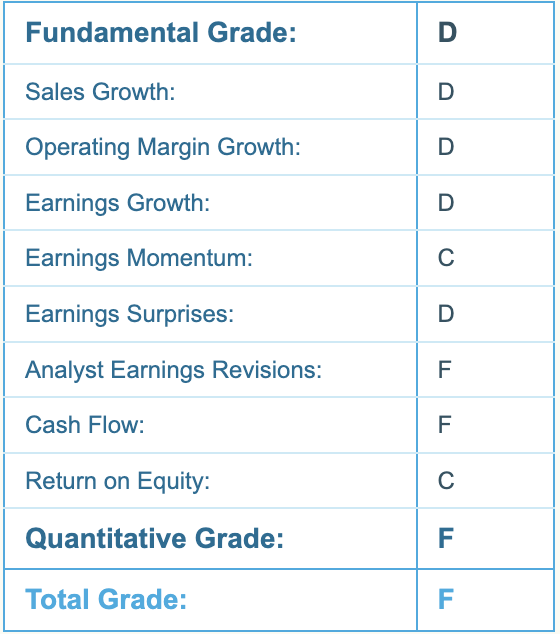

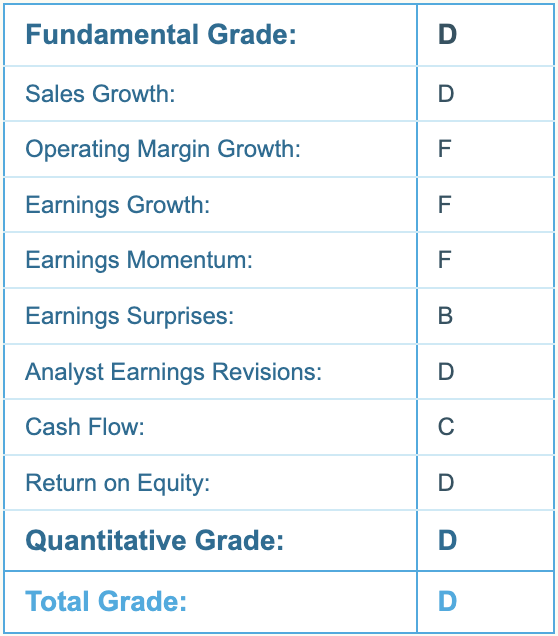

Navellier Report Card:

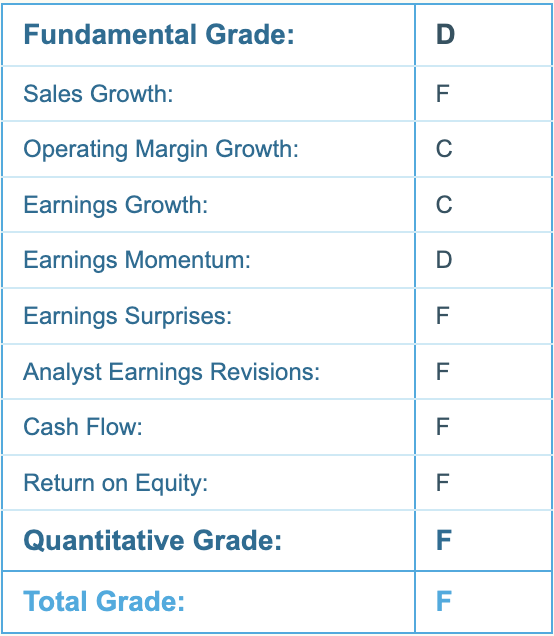

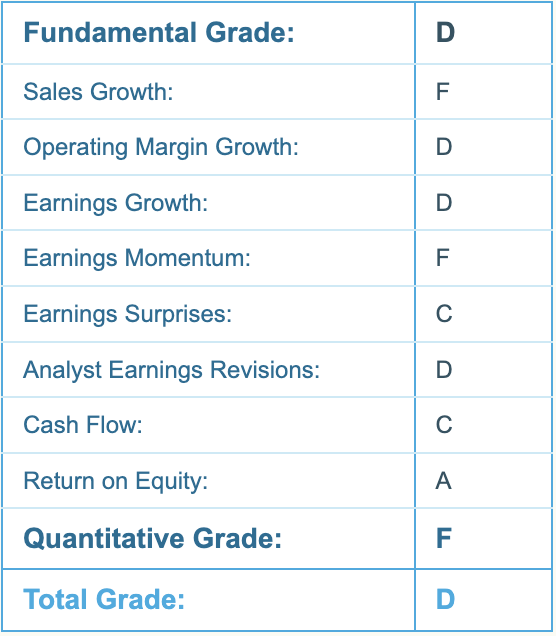

Crumbling Giant #2: AppLovin Corporation (APP)

Country: United States

Industry: Software – Application

Market Cap: $6.9 billion

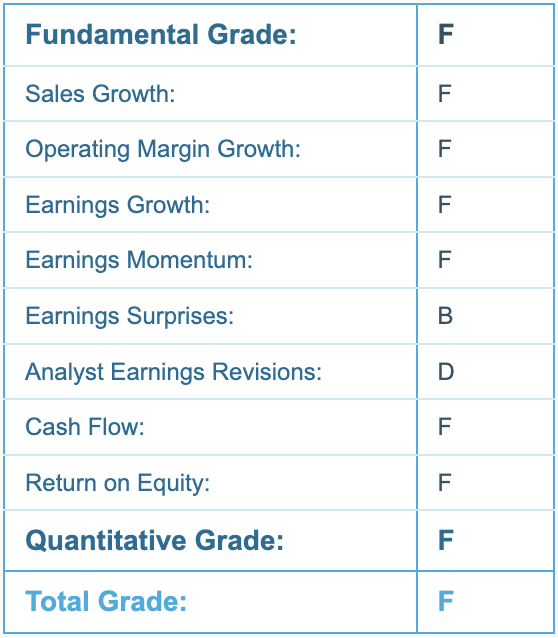

Navellier Report Card:

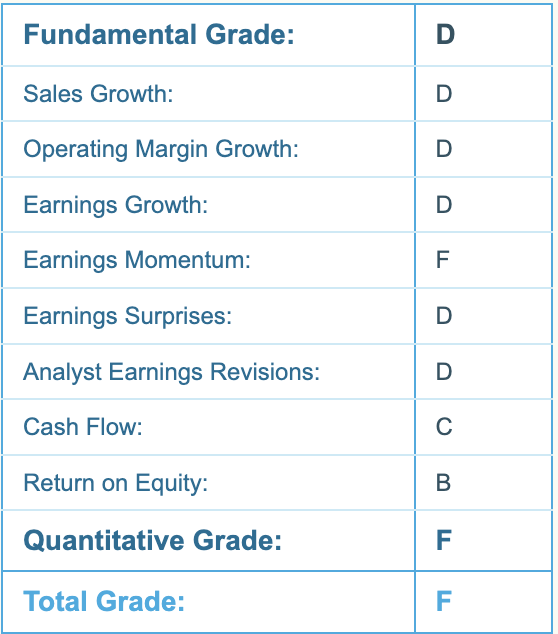

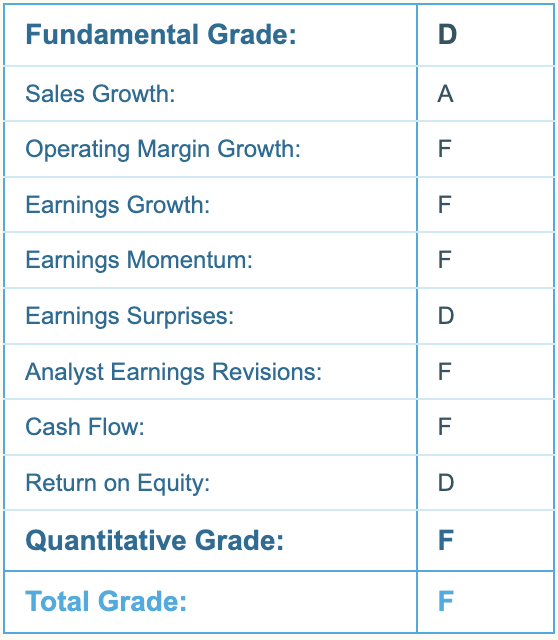

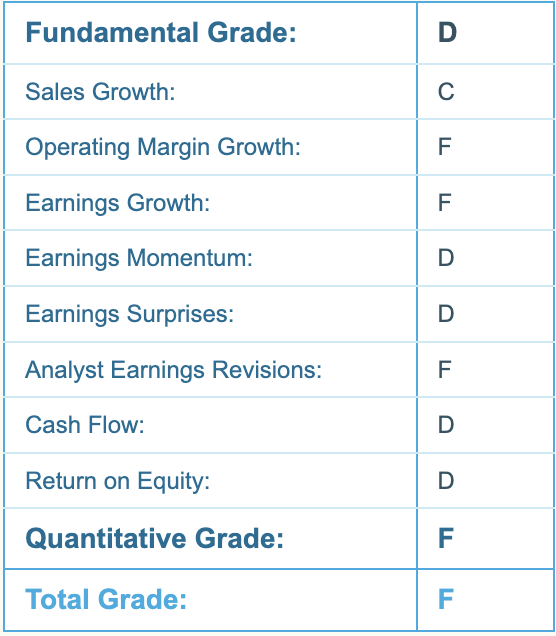

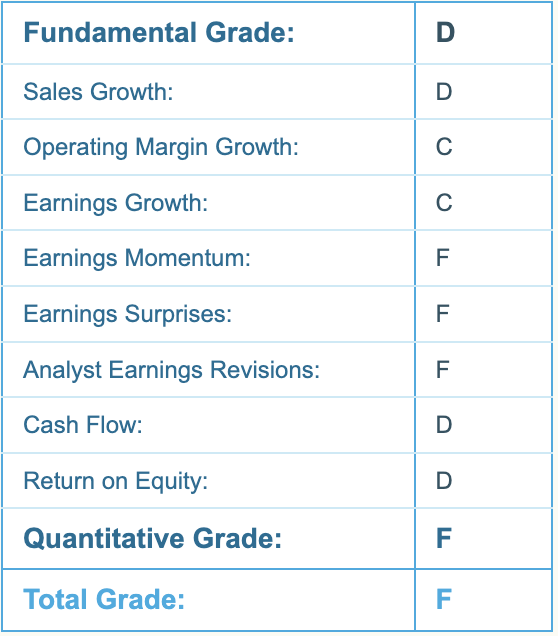

Crumbling Giant #3: Azenta, Inc. (AZTA)

Country: United States

Industry: Medical Instruments & Supplies

Market Cap: $3.6 billion

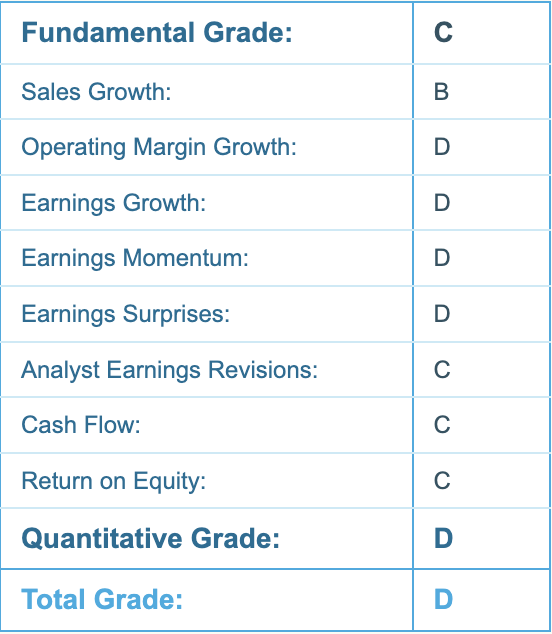

Navellier Report Card:

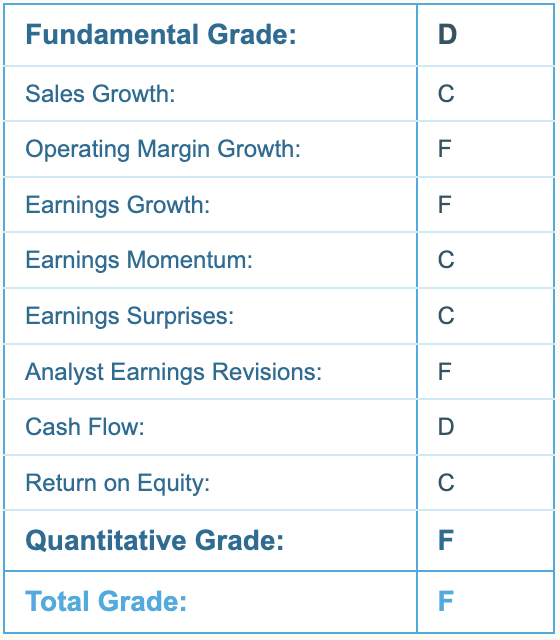

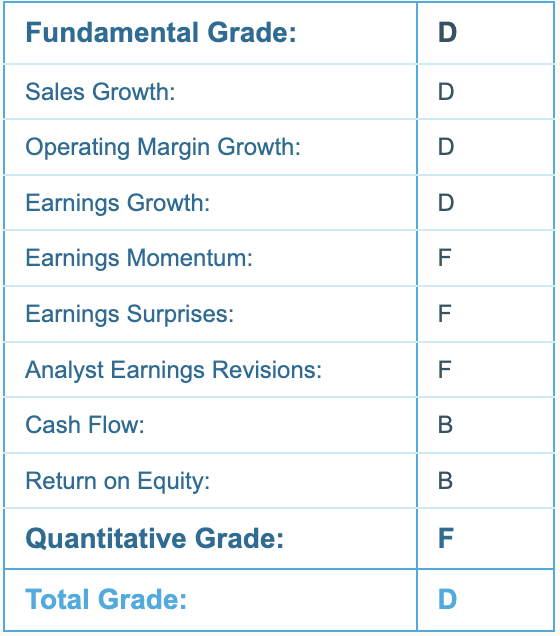

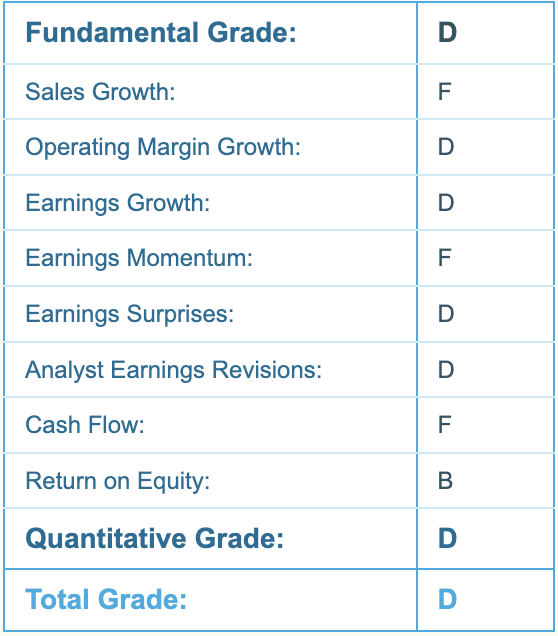

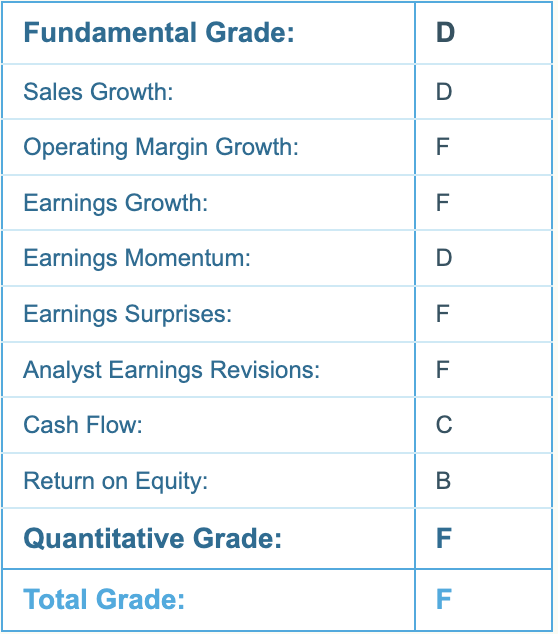

Crumbling Giant #4: Cable One, Inc. (CABO)

Country: United States

Industry: Telecom Services

Market Cap: $4.8 billion

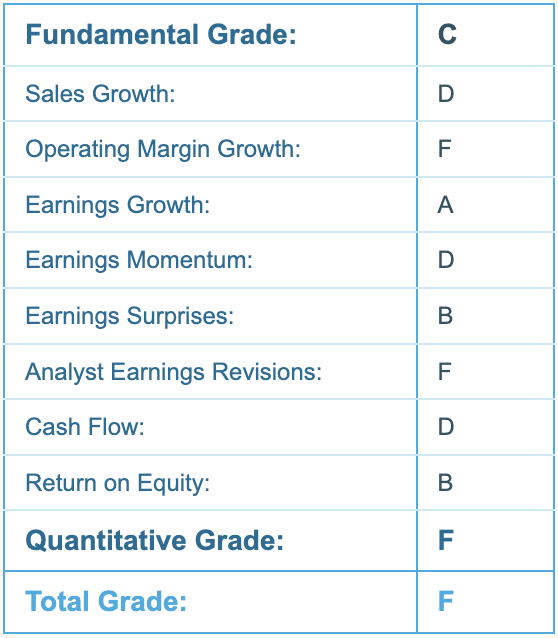

Navellier Report Card:

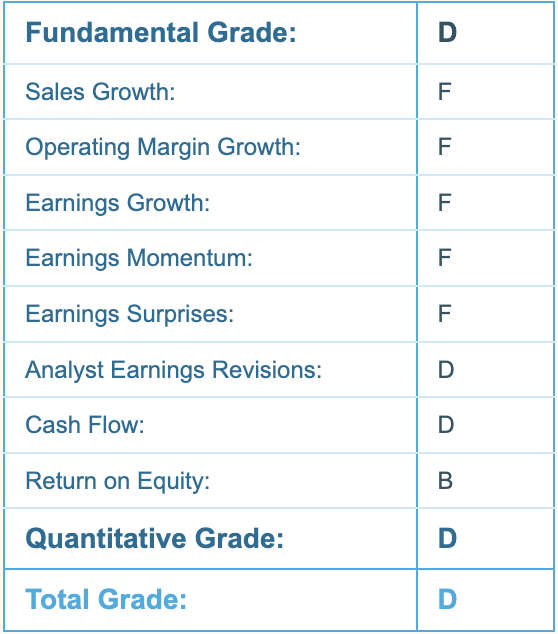

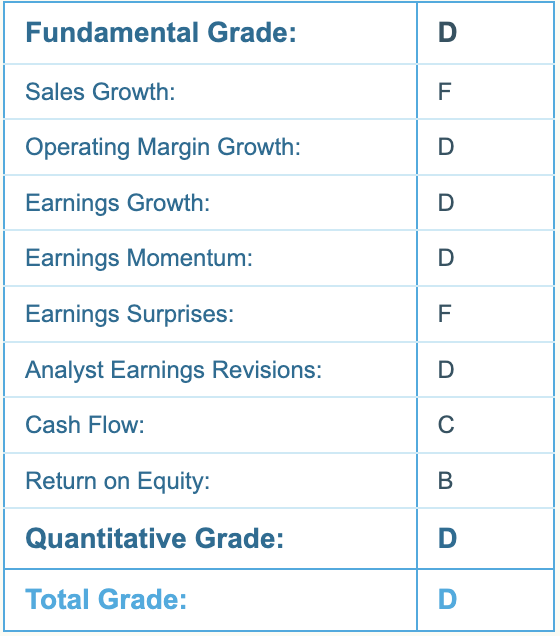

Crumbling Giant #5: Evotec SE (EVO)

Country: Germany

Industry: Drug Manufacturers – Specialty & Generic

Market Cap: $3.5 billion

Navellier Report Card: Navellier Report Card:

Crumbling Giant #6: First American Financial Corporation (FAF)

Country: United States

Industry: Insurance – Specialty

Market Cap: $4.9 billion

Navellier Report Card:

Crumbling Giant #7: Fresenius Medical Care AG & Co. (FMS)

Country: Germany

Industry: Medical Care Facilities

Market Cap: $8.5 billion

Navellier Report Card:

Crumbling Giant #8: IAC Inc. (IAC)

Country: United States

Industry: Internet Content & Information

Market Cap: $4.5 billion

Navellier Report Card:

Crumbling Giant #9: Intel Corporation (INTC)

Country: United States

Industry: Semiconductors

Market Cap: $113.3 billion

Navellier Report Card:

Crumbling Giant #10: CarMax, Inc. (KMX)

Country: United States

Industry: Auto & Truck Dealerships

Market Cap: $9.9 billion

Navellier Report Card:

Crumbling Giant #11: Maximus, Inc. (MMS)

Country: United States

Industry: Specialty Business Services

Market Cap: $3.6 billion

Navellier Report Card:

Crumbling Giant #12: Match Group, Inc. (MTCH)

Country: United States

Industry: Internet Content & Information

Market Cap: $12.8 billion

Navellier Report Card:

Crumbling Giant #13: Nomura Holdings, Inc. (NMR)

Country: Japan

Industry: Capital Markets

Market Cap: $9.9 billion

Navellier Report Card:

Crumbling Giant #14: Pegasystems Inc. (PEGA)

Country: United States

Industry: Software – Application

Market Cap: $2.8 billion

Navellier Report Card:

Crumbling Giant #15: PENN Entertainment, Inc. (PENN)

Country: United States

Industry: Resorts & Casinos

Market Cap: $5.2 billion

Navellier Report Card:

Crumbling Giant #16: Peloton Interactive, Inc. (PTON)

Country: United States

Industry: Leisure

Market Cap: $2.7 billion

Navellier Report Card:

Crumbling Giant #17: Roku, Inc. (ROKU)

Country: United States

Industry: Entertainment

Market Cap: $7.5 billion

Navellier Report Card:

Crumbling Giant #18: SK Telecom Co., Ltd (SKM)

Country: South Korea

Industry: Telecom Services

Market Cap: $7.6 billion

Navellier Report Card:

Crumbling Giant #19: SL Green Realty Corp. (SLG)

Country: United States

Industry: REIT – Office

Market Cap: $2.6 billion

Navellier Report Card:

Crumbling Giant #20: The Scotts Miracle-Gro Company (SMG)

Country: United States

Industry: Agricultural Inputs

Market Cap: $2.7 billion

Navellier Report Card:

Crumbling Giant #21: Sun Communities, Inc. (SUI)

Country: United States

Industry: REIT – Residential

Market Cap: $16.7 billion

Navellier Report Card:

Crumbling Giant #22: Stanley Black & Decker, Inc. (SWK)

Country: United States

Industry: Tools & Accessories

Market Cap: $11.8 billion

Navellier Report Card:

Crumbling Giant #23: Teledoc Health, Inc. (TDOC)

Country: United States

Industry: Health Information Services

Market Cap: $4.4 billion

Navellier Report Card:

Crumbling Giants #24: T. Rowe Price Group, Inc. (TROW)

Country: United States

Industry: Asset Management

Market Cap: $24.9 billion

Navellier Report Card:

Crumbling Giant #25: 10x Genomics, Inc. (TXG)

Country: United States

Industry: Health Information Services

Market Cap: $3.2 billion

Navellier Report Card:

Crumbling Giant #26: V.F. Corporation (VFC)

Country: United States

Industry: Apparel Manufacturing

Market Cap: $11.2 billion

Navellier Report Card:

Crumbling Giant #27: Wayfair Inc. (W)

Country: United States

Industry: Internet Retail

Market Cap: $3.8 billion

Navellier Report Card:

Once you’ve cross-checked this list of 27 Crumbling Giants You Need to Sell Today, to make sure you’re not carrying any of these mammoth drags on your wealth…

Here’s what to do with your money instead.

How to Find the Market Leaders of 2023 (and Beyond)

Remember, buying pressure is key. When a stock attracts a lot of cash from big Wall Street institutions, that’s about the biggest “shot in the arm” it could possibly get. So, money flow is the best sign that the share price will continue to climb (or fail).

So, where is the money going now? Well, sky-high inflation is still a big factor.

Much of the inflation is caused by stupid government policies that may last for decades, due to record budget deficits, the war on domestic fossil fuel production and transportation, and now soaring electric vehicle (EV) prices due to an acute shortage of lithium and cobalt.

The reality is inflation is expected to persist for the foreseeable future, so you have two options: worry about all the problems in the world or choose to profit from them. Personally, I pick option two.

My Growth Investor service features the companies that are well-positioned to continue to prosper from inflation that has enveloped the world. They’re the very stocks that are set to enjoy a flood of “smart money” from Wall Street. Check out my full briefing on this phenomenon here.

Sincerely,

Louis Navellier

Editor, Growth Investor