A holiday-shortened week is looking like it will get off to a lower start, as China landed some weak growth numbers and more earnings roll out. That’s after two positive weeks to start 2023.

But there’s more than a whiff of bullishness in the air, according to our call of the day, from investment research platform Macro Ops’ founder and chief investment officer Alexander Barrow.

“The weight of the evidence strongly tipped in favor of the bulls last week after a number of high signal breadth thrusts triggered,” writes the Macro Ops team in a Monday blog post. They see that could drive some decent S&P 500 gains before “it rolls over again.”

Market breadth refers to how many stocks are participating in an up or down move. Breadth thrust indicators can determine where markets are going, and according to some, are often be found at the start of new bull markets.

“It’s our view we’re in a broader topping process at best as we expect a recession near the end of the year. But after last week we have to be open to the possibility of a run at the prior Jan highs, which would be 20% above current levels,” says the Macro Ops team.

Read: U.S. stocks could fall 10% as ‘pain trade’ takes hold before bouncing back later in the year

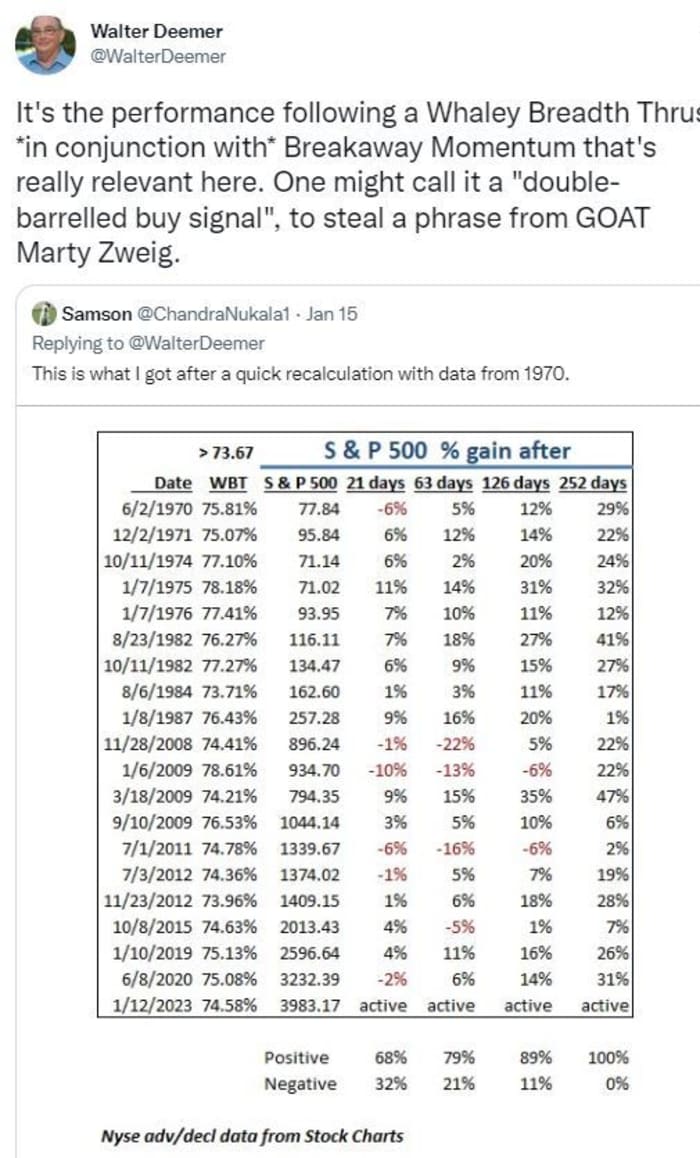

They pointed to others who also noticed some breadth thrust indicators last week, including evidence of an “unprecedented breadth trifecta form Quantifiable Edges. The first part of that is longtime investor Walter Deemer’s Breakaway Momentum signal that indicates “really powerful upside momentum,” which he tweeted about recently:

@WalterDeemer

The rest of that triple signal came from Wayne Whaley’s Advance Decline Thrust and then the Quantifiable Edges own Triple 70 thrust signal.

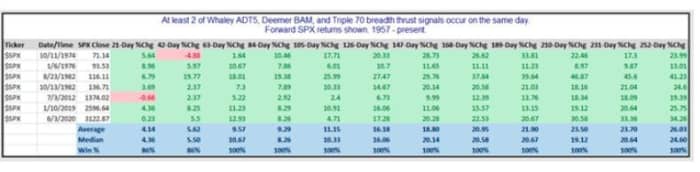

As Quantifable Edges pointed out, Thursday was the first time all three landed on the same day. Two of three signals triggered the same day has happened only seven times, according to the chart below:

Quantifiable Edges

Apart from flagging a string of bullish indicators, the Macro Ops team offers some investing advice as well — they suggest exposure to home builders right now (a sector they flagged in November.)

“The market is waaaay overweight a recession in the 1st half of this year, when economic data and monetary lags behind suggests that’s not going to happen until closer to year’s end. This means Q1/Q2 earnings won’t be as bad as many expect, which means people are underweight risk. A reverting risk-cycle + a reopening China should help compress wide mortgage spreads, boosting demand in a supply constrained market, which is good for builders,” says the team, who like BlueLinx Holdings

BXC,

and Builders FirstSource

BLDR,

Read: Fund managers are ‘a lot less bearish’ than the fourth quarter, says Bank of America

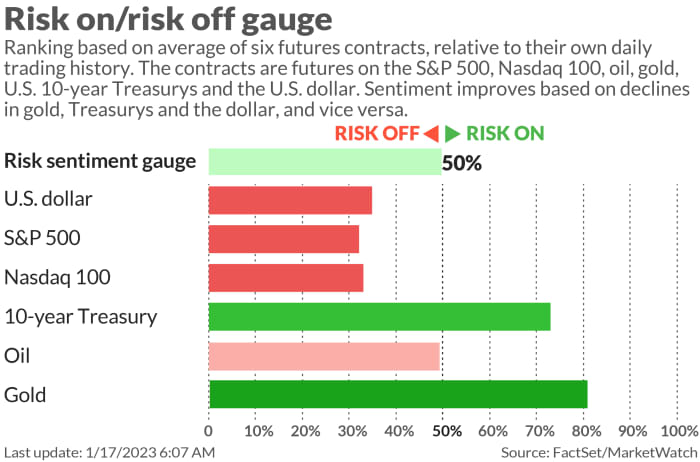

The markets

MarketWatch

Stock futures

ES00,

NQ00,

are lower, while bond yields

TMUBMUSD10Y,

TMUBMUSD02Y,

are headed the other way, along with the dollar

DXY,

U.S. crude prices

CL.1,

are steady and gold

GC00,

is dropping. Bitcoin

BTCUSD,

spiked above $21,000 over the weekend and continues to trade above that level.

The buzz

On the heels of a big batch of Wall Street bank earnings last week, Goldman Sachs’

GS,

has reported disappointing results, along with provisions for credit losses, and shares are down in premarket. Morgan Stanley

MS,

stock is slightly lower as earnings topped estimates by a penny per share, and credit-loss provisions surged. Signature Bank

SBNY,

also reported and shares are slightly higher despite an earnings miss.

Travelers

TRV,

stock is falling after the insurer’s guidance fell short of market hopes.

Netflix

NFLX,

will report later this week.

Shares of National instruments

NATI,

are higher in premarket after Emerson Electric

EMR,

lifted its bid for the measurements systems maker to $7.6 billion.

Stocks of Chinese EV maker Xpeng

XPEV,

are down after the Chinese EV maker cut prices for most of its cars by around 10%, following similar moves by Tesla earlier this month.

China announced its first overall population decline in decades as society ages and birthrates plunge. And it reported data showing its economy grew by 3% in 2022, less than half of the previous year’s 8.1% rate, the second-lowest annual rate since at least the 1970s.

Meme-stock investor Ryan Cohen has reportedly taken a stake in China’s Alibaba

BABA,

and launched an activist campaign to get the e-commerce giant to buyback more shares. Shares are slightly lower.

The Empire State manufacturing index is ahead, in a week that will bring updates on retail sales and the housing market, along with other data and some Fed speak.

The founders of defunct crypto hedge fund Three Arrows Capital and crypto exchange CoinFlex are pitching a new crypto exchange that will focus on claims trading.

Best of the web

Deaths of despair may be driven by loss of religion, new research paper argues

The return of El Niño will bring unprecedented heat waves this year, climate experts warn

400 people told the New York Times how much money they make.

A famed genetics professor fined $29 million after convincing friend to invest $20 million in his “miracle” Huntington’s disease cure.

The chart

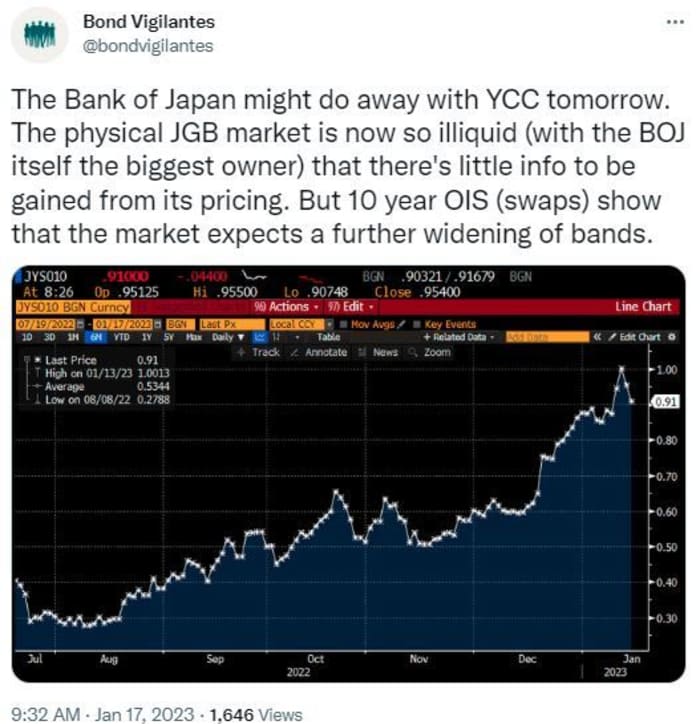

@bondvigilantes

The biggest macro decision of the week could come from the Bank of Japan on Wednesday, as speculation build that the central bank could end its ultra-easy monetary policy and yield curve control.

“The Bank has had to buy a record amount of Japanese government bonds to defend the policy since it was tweaked in December, with recent buying far exceeding prior peaks,” points out Gurpreet Gill, macro strategist for global fixed income at Goldman Sachs Asset Management.

For now, watch the yen

USDJPY,

and JGBs, say strategists.

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m. Eastern Time:

| Ticker | Security name |

|

BBBY, |

Bed Bath & Beyond |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment Holdings |

|

MULN, |

Mullen Automotive |

|

NIO, |

NIO |

|

BABA, |

Alibaba |

|

APE, |

AMC Entertainment Holdings preferred shares |

|

AAPL, |

Apple |

|

DWAC, |

Digital World Acquisition |

Random reads

Scientists steer lightening bolts with laser beams for the first time.

Wyoming lawmakers want to ban electric-car sales, to protect the oil-and-gas industry.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.