[Editor’s note: “It’s the Perfect Time to Buy Amazon Stock” was previously published in January 2023. It has since been updated to include the most relevant information available.]

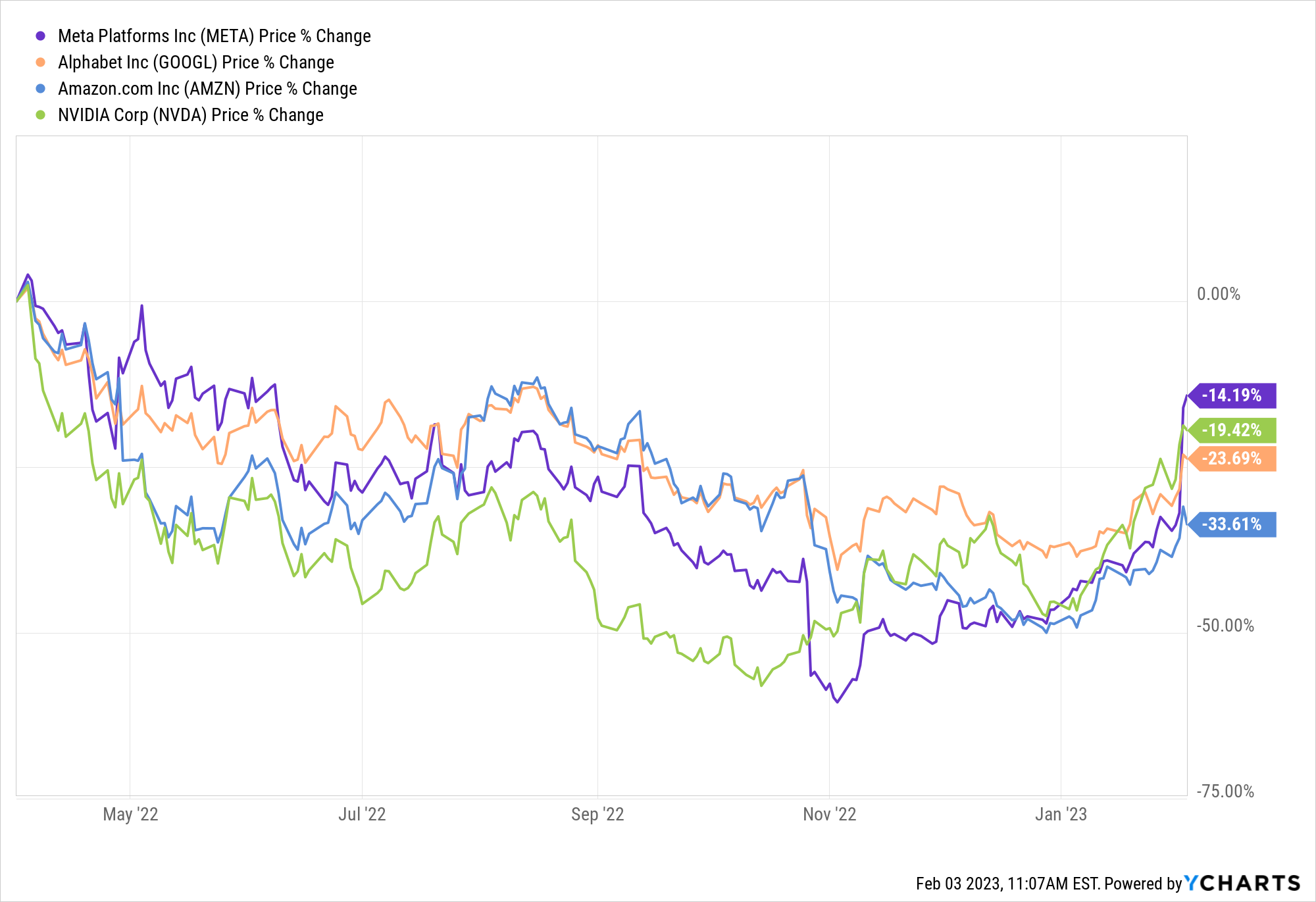

I’m no long-term fan of Big Tech stocks. Earlier last year, I made the bold claim that Big Tech stocks were dead, calling for the demise of giants like Meta (META), Alphabet (GOOG, GOOGL), Nvidia (NVDA), and Amazon (AMZN).

Through January of this year, those stocks had all collapsed more than 37%. And after the recent round of earnings reports, those titans are starting to rise again. But they’re all still down more than 14%.

At this time last year, Big Tech stocks were still loved as unstoppable growth giants, trading at lofty valuations that priced in perfection. That was the time to sell them.

Now, though, we have a completely different setup.

Big Tech stocks have crashed. Once unstoppable, they are now vulnerable. Before, they traded at lofty valuations that priced in perfection. And now, they’re trading at discounted valuations that price in little to no growth.

Yet, many of these firms still represent some of the biggest, most successful, and most profitable enterprises to ever exist.

Now’s the time to buy Big Tech stocks. That’s just what you do with long-term winners. You sell them when they are overhyped and undervalued. You buy them when they are underappreciated and undervalued.

Right now, those stocks are underappreciated and undervalued. So, let’s buy this dip.

One Big Tech stock we’re particularly bullish on here and now is Amazon stock.

Amazon Is still Amazon

After reporting quarterly earnings on Thursday, AMZN stock sank about 4.5%. The giant beat on revenue, but missed on EPS and provided light guidance. Most notable to the media and many investors alike, the titan missed on net sales in its cloud division ($21.3 billion actual versus $21.76 billion expected).

Amazon’s recent quarter wasn’t awful or horrible. Yes, EPS and sales missed expectations, and the cloud business did slow sequentially. But that cloud business is still growing revenues at a 20% year-over-year clip. And it slowed in line with the cloud slowdowns at Alphabet and Apple (AAPL) – so Amazon Web Services isn’t losing share. The cloud industry is just going through a temporary cyclical slowdown that will reverse course when the economy improves.

Nothing worrisome there at all.

Meanwhile, the ad business actually saw its growth rates accelerate in the quarter to 19%. Against the backdrop of Meta and Alphabet’s YouTube division reporting negative ad revenue growth, that’s very impressive. Amazon’s ad business is clearly gaining significant market share.

Plus, the company’s physical store business continues to grow steadily.

Sure, profit margins are under pressure, and broadly, revenue growth rates are slowing. But that’s almost entirely a function of FX headwinds, which are likely to abate in the coming quarters.

So, when you put it all together, Amazon is still a leader in the secular growth cloud industry. And it’s a share-gainer in the secular growth digital ad industry. Amazon remains a behemoth of a company.

When a behemoth of a company like this goes on sale, it’s time to buy. And Amazon stock is finally on sale.

Amazon Stock Is Super Cheap

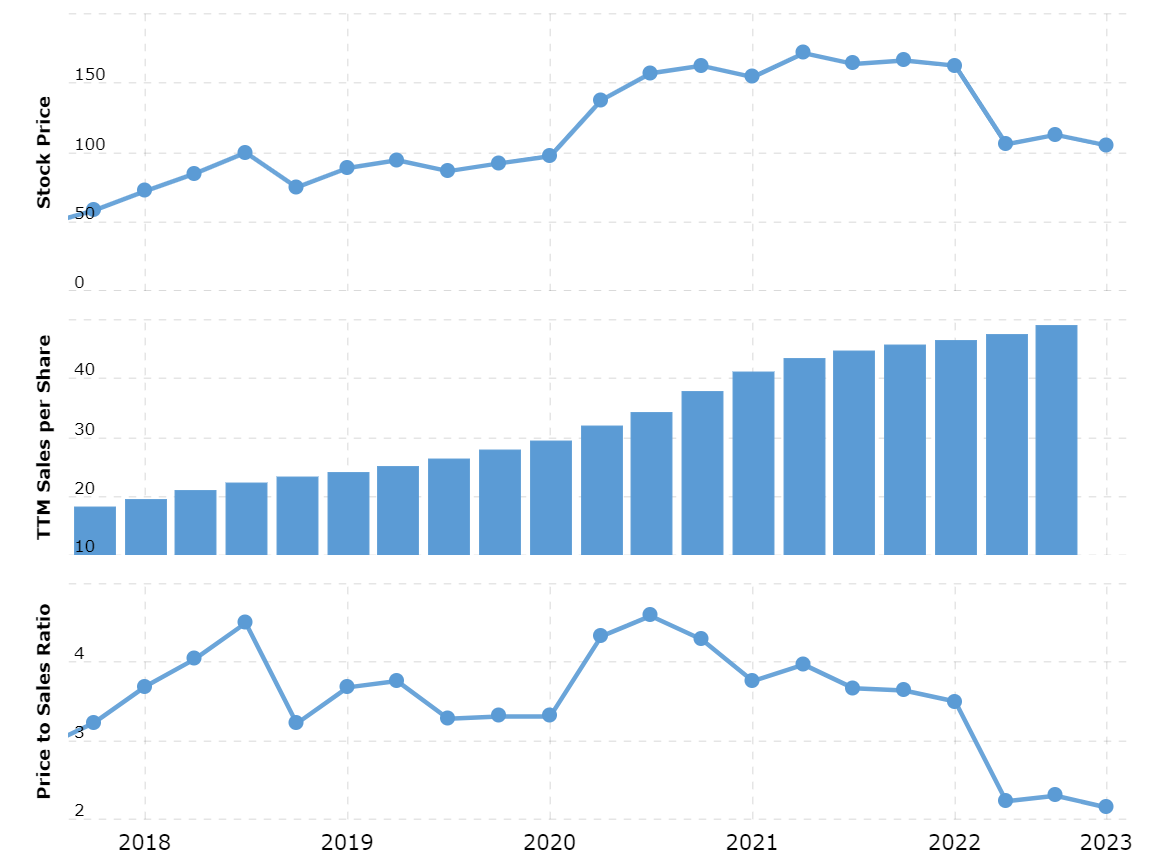

After its recent plunge, Amazon stock has become dirt-cheap – cheap enough to warrant buying the dip now.

The stock is trading around 2.2X trailing sales, below the stock’s five-year-average multiple of around 3.4X. That’s also the lowest valuation multiple for the stock since 2015 – before the company’s cloud business caught fire and made the firm consistently profitable.

That multiple is just too low for this stock. To illustrate why, let’s model the business out five years.

Amazon’s online retail business will likely grow at a fairly steady 10% annualized clip over the next few years. The physical store business is good for about 5% growth per year. The ad business will likely grow around 20% per year, representative of market share expansion in a 10% to 15% growth industry. And the cloud business will likely grow around 25% per year, in line with market estimates for cloud spending growth.

Altogether, this is a company with clear visibility to mid-teens revenue growth over the next five years. Operating margins have room to expand to 10%, as the high-margin ad and cloud businesses comprise a bigger slice of the sales pie. When you run the math on those projections, it becomes clear that Amazon will easily be able to net about $8 in earnings per share by 2027.

Slap a simple 20X forward earnings multiple on that. That implies a 2026 price target of $160 for Amazon stock. Discount that back by 10% per year. You arrive at a 2023 price target around $120.

Amazon stock trades around $108 today. High-quality firms like Amazon rarely – if ever – trade below their fair value. When they do, you simply must take advantage.

So, do yourself a favor, and buy this dip with high conviction.

The Final Word

The current phenomenon happening in Amazon stock is a microcosm of what’s happening across the entire stock market.

Due to cyclical fears related to a potential recession, dozens of super high-quality stocks with growing revenues, profits, and cash flows are seeing their stock prices get crushed.

This happens all the time. About once a decade, investors start worrying about a potential recession. High-quality stocks see their prices get crushed – but their revenues, earnings, and cash flows keep growing. Investors who buy the dip in those stocks end up making a ton of money – because they always bounce back in a big way.

This time will prove no different. Investors who buy the dip in high-quality stocks that were crushed in 2022 will make a ton of money in 2023 and ‘24. It’s that simple.

Amazon stock is one such investment. But it is far from the only one.

And we believe what comes next is a big rally, so the window to capitalize on these stock price divergences is rapidly closing.

Is your portfolio positioned for this rare trading phenomenon?

Let us tell you about the best stocks to buy to play this great divergence.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.