It’s finally time for tech stocks to stage a huge comeback.

We’ve all been waiting for this moment. Ever since tech stocks started crashing in late 2021, we knew that they’d eventually bottom. And we knew that when they did, it’d create the buying opportunity of the century…

Like when tech stocks bottomed after the COVID crash and soared more than 130% in less than two years.

Like when tech stocks bottomed after the 2008 financial crisis and rocketed 120% over the next two years.

Or like when tech stocks bottomed after the dot-com bubble and popped about 100% over the next year.

We’ve all been waiting for that moment; the bottom – then the surge.

And we think it has finally arrived.

Tech Stocks Are Regaining Their Mojo

You may have noticed. Tech stocks are starting to get their “mojo” back. The tech-heavy Nasdaq soared 2.5% on Thursday. It’s up 12% so far in 2023, marking one of its best starts to a year ever. It has retaken its 50-day, its 100-day, and its 200-day moving averages.

Tech stocks clearly have some newfound momentum.

Can it last? Yes. But more than that, tech stocks are about to catch fire and stage one of their biggest comebacks ever.

Why? Inflation and rate hikes – or more specifically, the lack of those two things.

In 2022, tech stocks were dragged down by rising inflation and interest rate hikes. Both headwinds will disappear in 2023.

Inflation – as measured by the Consumer Price Index – peaked in mid-2022 at 9.1%. It has since dropped all the way to 6% in February. Looking at real-time Truflation data, which measures millions of data points and contrasts outdated government metrics, it looks like inflation is tracking toward 4% in March.

Inflation is unequivocally crashing.

Meanwhile, interest rates will likely stop rising soon.

The financial sector has started to break over the past week because of the Fed’s rapid increase in interest rates. Silicon Valley Bank and Signature Bank failed. Credit Suisse (CS) and First Republic (FRC) almost failed.

To be sure, those failures didn’t break the back of the U.S. economy. The U.S. government essentially rescued SVB and Signature. The Swiss government rescued Credit Suisse. And major Wall Street banks saved First Republic.

But the Fed knows that if it keeps pushing the envelope – and stays the course with rate-hike after rate-hike – the breaks will get bigger. And bigger breaks could crush the economy.

The Fed doesn’t want to crush the economy. And it also knows that inflation is falling rapidly. So, the most likely path forward is a 25-basis-point rate-hike next week, and then a pause.

Net-net, both inflation and interest rates rose throughout 2022. Now, neither will rise in 2023.

This inflection point marks the beginning of the massive tech stock comeback.

The Final Word

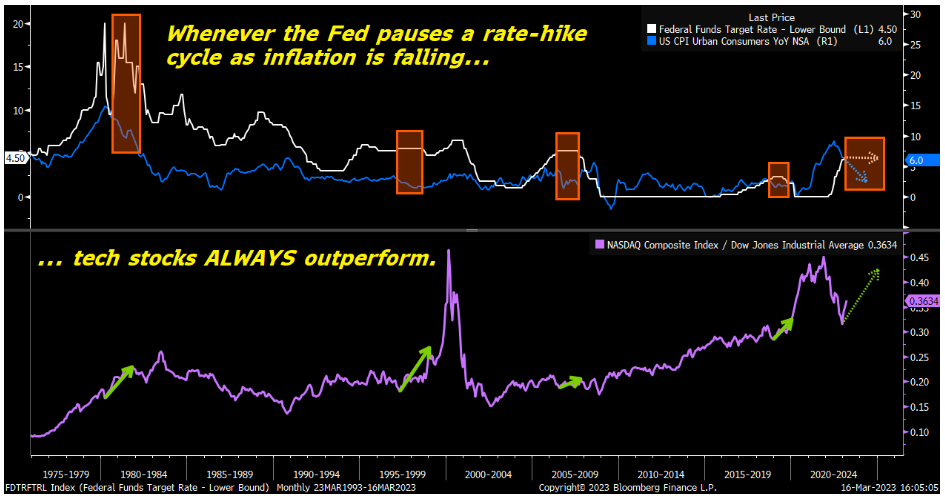

Historically speaking, whenever the Fed pauses a rate-hike cycle as inflation is falling – exactly the situation we will have in 2023 – tech stocks always outperform:

Either this is the first time in history that the combination of steady interest rates and falling inflation equals tech stock underperformance, or…

Tech stocks are about to stage an epic comeback.

We’ll go with the latter.

Tech stocks have regained their mojo, and the party’s just getting started.

But if you want to maximize your returns in this comeback, you can’t just settle on buying the Invesco QQQ ETF (QQQ) – an ETF that tracks the Nasdaq.

You need to buy the high-flying stocks that will lead this rally.

Back in 2020 – the last time tech stocks staged a huge comeback – more than a dozen rose over 1,000% in a year.

The Nasdaq may rise 100% over the next two years. But certain individual stocks will rise much, much more than that.

Find out which stocks could lead this epic 2023 comeback.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.