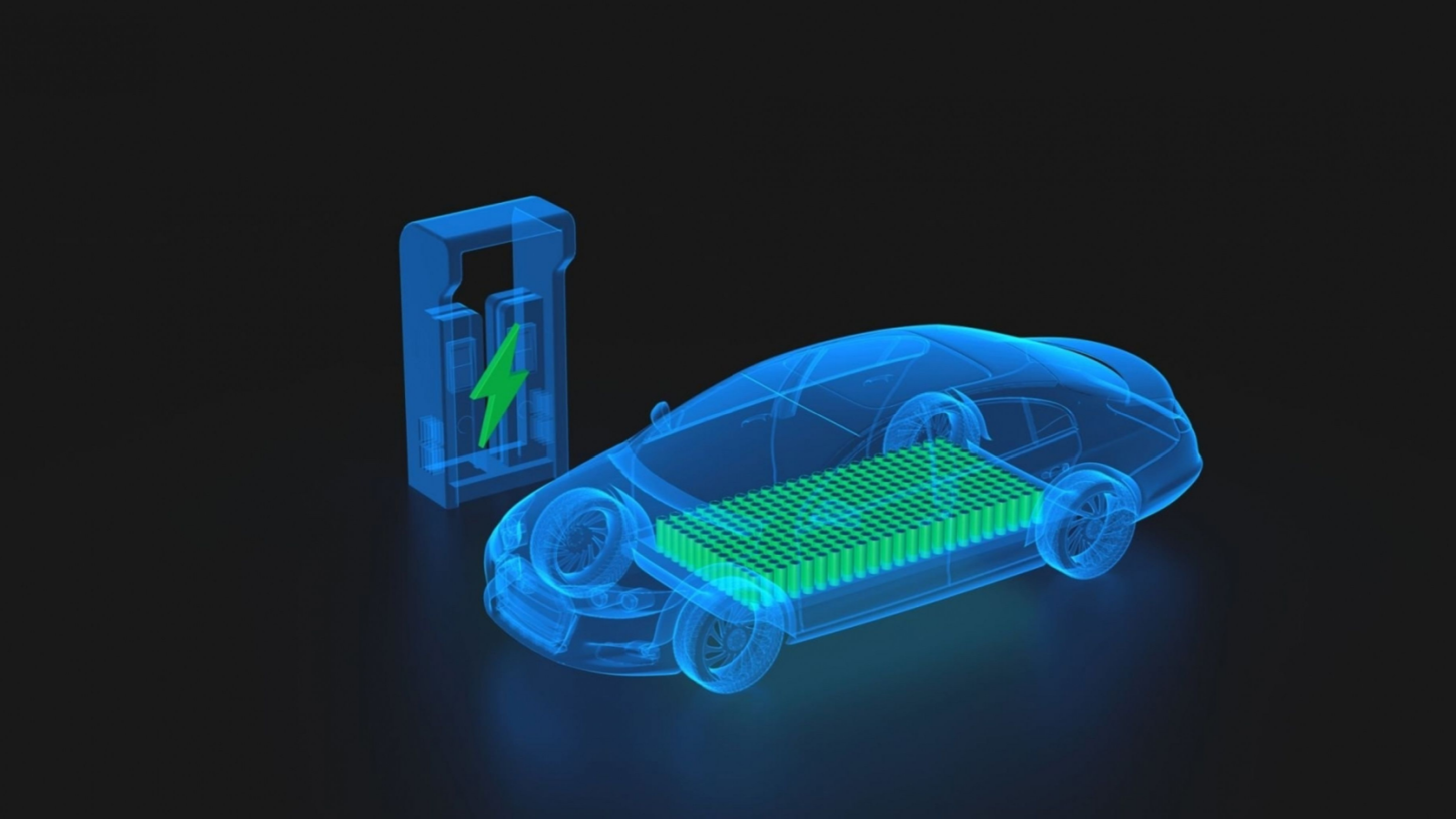

EV battery stocks could be on the precipice of a strong rally. The catalyst of this potential rally comes from a company that’s revolutionizing the solid-state battery market, QuantumScape (NYSE:QS). To put this rally into context, QS stock is on the verge of commercializing its batteries and this development is expected to be disruptive if it occurs.

QS stock’s solid-state batteries offer greater energy density, safety, longer lifespan, and faster charging capabilities. Prototypes of these batteries have already been sent to automakers such as Volkswagon (OTCMKTS:VWAGY) for review.

However, it seems likely that solid-state batteries will arrive on the market, regardless of QS stock’s involvement. This brand is recognized by analysts as being one of the leaders taking a huge risk in bringing them to manufacturers first.

These three EV battery stocks can help you hop on board this potentially disruptive tailwind.

LG Chem (LGCLF)

LG Chem (OTCMKTS:LGCLF) is one of my favorite picks to take advantage of the solid-state battery development. The company is headquartered in South Korea and has a significant presence in Asia and in regions such as North America.

Its core operating segment involves the key chemicals required for lithium-ion batteries and other products. It’s a notable supplier of ethylene and propylene, as well as polymers and other high-value-added chemical products.

Looking ahead, the company has an explicitly bullish outlook for batteries this year and into the future. LG Chem’s CEO, Shin Hak Cheol, expects the battery industry to grow by up to 25% this year despite global demand easing.

Panasonic (PCRFY)

Panasonic (OTCMKTS:PCRFY) is another major player in the EV battery market. It’s a recognizable brand for millions of consumers worldwide, and it’s increasingly moving towards higher margin lines of business.

One of PCRFY’s more adventurous endeavors is through its collaboration with Tesla (NASDAQ:TSLA) for models like the Model S and Model 3. Panasonic supplies the batteries for these vehicles.

The company also recently announced plans that could lead to a dominant position in the EV space. Panasonic plans to quadruple its EV battery capacity to 200 gigawatt-hours annually by 2031, with a focus on North America, and will utilize U.S. tax credits via the 2022 Inflation Reduction Act.

PCRFY only trades at 7x earnings which offers a high margin of safety.

Albemarle (ALB)

Albemarle (NYSE:ALB) is the final company for investors to consider if they are bullish on QuantumScape bringing solid-state batteries to the masses.

The company’s focus on lithium extraction and processing makes it integral to the EV battery supply chain. Many contributors here at InvestorPlace have listed it as one of the best lithium stocks to buy, thanks to its powerful distribution networks to battery manufacturers and its refinement operations.

However, amid the falling spot prices for lithium and waning cyclical demand, the company has stated it will reduce its 2024 capital expenditures to around $1.7 billion and aims to lower expenses by $95 million annually. It will also lay off some of its workers as it attempts to reorganize the business to focus on better opportunities.

Layoffs may be rightfully considered a red flag, but in ALB stock’s case, this is more due to market fluctuations than a structural issue within the company.

On the date of publication, Matthew Farley did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.