Oil futures popped higher Sunday evening, after a drone attack that killed three U.S. service members in northern Jordan, blamed by the White House on Iran-backed militants, marked a major escalation of tensions in the Middle East.

West Texas Intermediate crude for March delivery

CL00,

CLH24,

was up $1.09, or 1.4%, at $79.10 a barrel on the New York Mercantile Exchange. March Brent crude

BRN00,

BRNH24,

the global benchmark, gained $1.11, or 1.3%, to trade at $84.66 a barrel on ICE Futures Europe.

Much will ultimately depend on the U.S. response and whether Iran takes action aimed at shutting down the Strait of Hormuz, Tariq Zahir, managing member at Tyche Capital Advisors, told MarketWatch on Sunday afternoon.

“We are on the cusp of this escalating, which could seriously impact the flow of crude oil,” he said.

Three U.S. service members were killed and more than two dozen injured in a drone strike on a U.S. base in northeast Jordan, according to U.S. Central Command. They were the first U.S. fatalities in months of attacks on U.S. bases by Iran-backed militias since the start of the Israel-Hamas war in October.

President Joe Biden attributed the Sunday attack to an Iran-backed militia group and said the U.S. “will hold all those responsible to account at a time and in a manner (of) our choosing.” News reports said U.S. officials were still working to conclusively identify the precise group responsible for the attack, but have assessed that one of several Iranian-backed groups is to blame.

Some congressional Republicans called for direct retaliation on Iran.

“We must respond to these repeated attacks by Iran & its proxies by striking directly against Iranian targets & its leadership. The Biden administration’s responses thus far have only invited more attacks. It is time to act swiftly and decisively for the whole world to see,” wrote Sen. Roger Wicker of Mississippi, the senior Republican on the Senate Armed Services Committee, in a post on X.

Iran denied responsibility for the attack.

“Iran has nothing to do with the attacks in question,” a spokesman for the Iranian mission at the United Nations in New York told The Wall Street Journal. “The conflict has been initiated by the United States military against resistance groups in Iraq and Syria; and such operations are reciprocal between them.”

Oil futures rallied last week to their highest since November, but with gains attributed in part to production outages in the U.S. and more upbeat expectations around economic growth.

“Crude already has the wind to its back, so this will only offer further upside,” Chris Weston, head of research at Australian brokerage Pepperstone told MarketWatch in an email.

With the U.S. election later this year, “Biden needs to strike a balance between increasing aggression that potentially puts U.S. serviceman lives in danger and could potentially raise the cost of living…while also showing a defiant stance that shows his resolve against terror,” Weston said.

Oil prices have seen short-lived rallies around developments in the Middle East since the start of the Israel-Hamas war, but have failed to build in a lasting geopolitical risk premium. West Texas Intermediate crude

CL00,

CL.1,

the U.S. benchmark, remains around $15 below its 2023 peak in the mid-$90s set in late September. Brent crude

BRN00,

the global benchmark, pushed back above $80 a barrel last week.

Attacks by Iran-backed Houthi militants on Red Sea shipping have forced a rerouting of tankers and cargo ships. For crude, that’s had implications for the physical market but hasn’t interrupted the flow of crude from the Middle East.

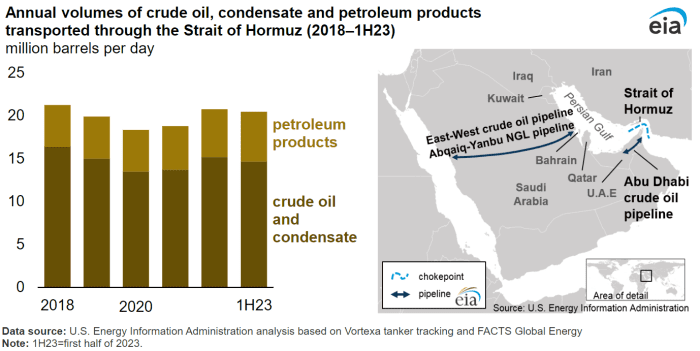

A move by Iran aimed at closing off the Strait of Hormuz, the world’s biggest oil-transportation chokepoint, remains a top worry.

The strait is a narrow waterway that links the Persian Gulf with the Gulf of Oman and the Arabian Sea. At its narrowest point, the waterway is only 21 miles wide, and the width of the shipping lane in either direction is just two miles, separated by a two-mile buffer zone.

Energy Information Administration

Around 21 million barrels a day of crude moved through the waterway in the first half of 2023, equivalent to around a fifth of daily global consumption, according to the U.S. Energy Information Administration.

The U.S. stock market has largely looked past Middle East tensions, with the S&P 500

SPX

returning to record territory this month, while the Dow Jones Industrial Average

DJIA

has also set a series of records.

Dow futures

YM00,

were off 94 points, or 0.3% as Asian trading got under way, while S&P 500 futures

ES00,

fell 12 points, or 0.2%, and Nasdaq-100 futures

NQ00,

lost 0.3%.

Read: Stock-market rally faces Fed, tech earnings and jobs data in make-or-break week

Away from oil, there were no signs of a significant surge in demand for instruments that traditionally serve as havens during periods of increased geopolitical tension. Futures on U.S. Treasurys

TY00,

saw a modest rise of 0.2%, while the U.S. dollar

DXY

was little changed versus major rivals and gold futures

GC00,

ticked up 0.4%.

Escalating Middle East tensions won’t go unnoticed by traders, but probably doesn’t warrant a “solid derisking,” Weston said, particularly with investors facing a barrage of major market events in the week ahead.

For U.S.-focused investors, the week ahead features a Federal Reserve policy meeting, earnings from tech industry heavyweights and a crucial December jobs report.

The Middle East situation “won’t take us too far off the rates, growth track, but we have an eye on whether this escalates,” Weston said.

—Associated Press contributed.