Malibu Boats Inc.’s stock fell in pre-market trading after the yacht maker reported a 72% drop in its second-quarter profit as high interest rates bit into its business.

While the Loudon, Tenn.-based company remains optimistic that conditions will improve, it still expects 2024 sales to drop from the mid-to-high thirties percentage.

Malibu Boats stock

MBUU,

dropped by 8.2% in premarket trading. Prior to Tuesday’s moves, the stock has fallen 15.8% in the past year, compared to a 34.9% gain by the Nasdaq.

In the most recent quarter, it ran into “weak retail demand” during its typically quiet time for business during the winter months.

Malibu Boats said its net income for the three months ended Dec. 31 fell to $11.27 million, or 49 cents a share, from $36.35 million, or $1.72 a share, in the year-ago quarter.

Adjusted profit in the latest quarter was 57 cents a share, ahead of the FactSet consensus estimate of 47 cents a share.

Revenue dropped 37% from $338.7 million to $211.1 million, below the analyst estimate of $219.6 million.

“We are recalibrating wholesale production to match retail demand as seasonality, along with continued interest rate pressures has resulted in elevated inventory levels,” said Chief Executive Jack Springer. “While the current macroeconomic outlook creates uncertainty, we are starting to see some positive signs.”

The company remains optimistic about its ability to return to growth as the market recovers, he said.

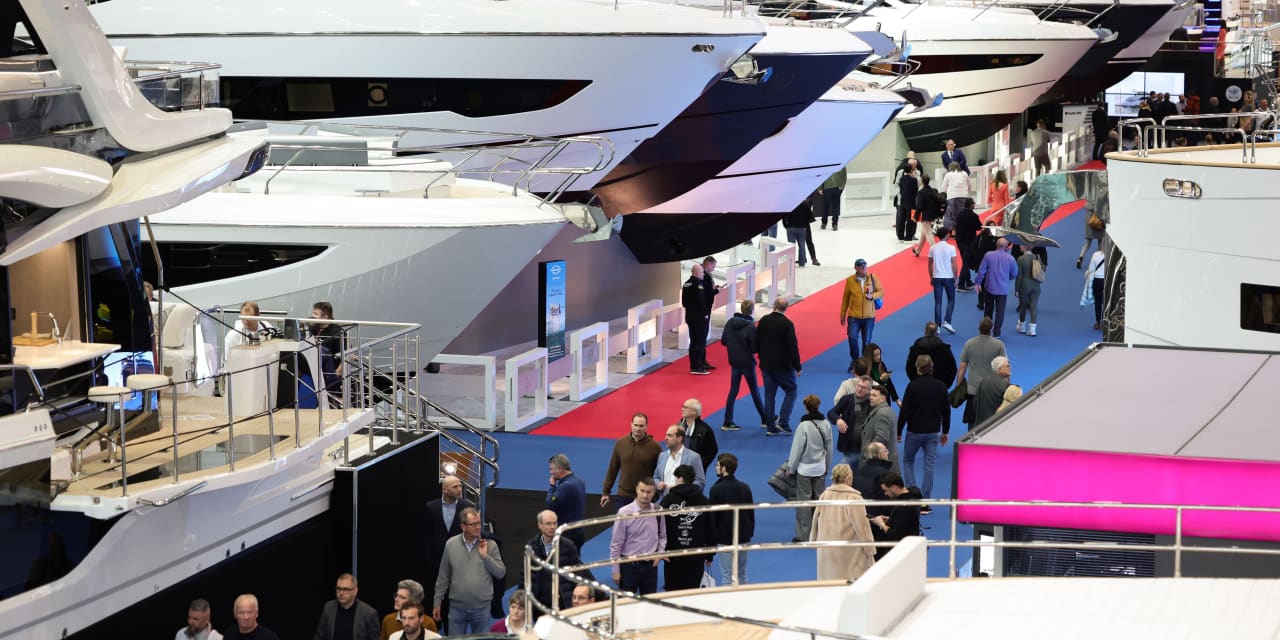

Malibu Boats said it’s looking toward the upcoming boat show season to “serve as an additional indicator of retail recovery.”

Check out On Watch by MarketWatch, a weekly podcast about the financial news we’re all watching — and how that’s affecting the economy and your wallet. MarketWatch’s Jeremy Owens trains his eye on what’s driving markets and offers insights that will help you make more informed money decisions. Subscribe on Spotify and Apple.