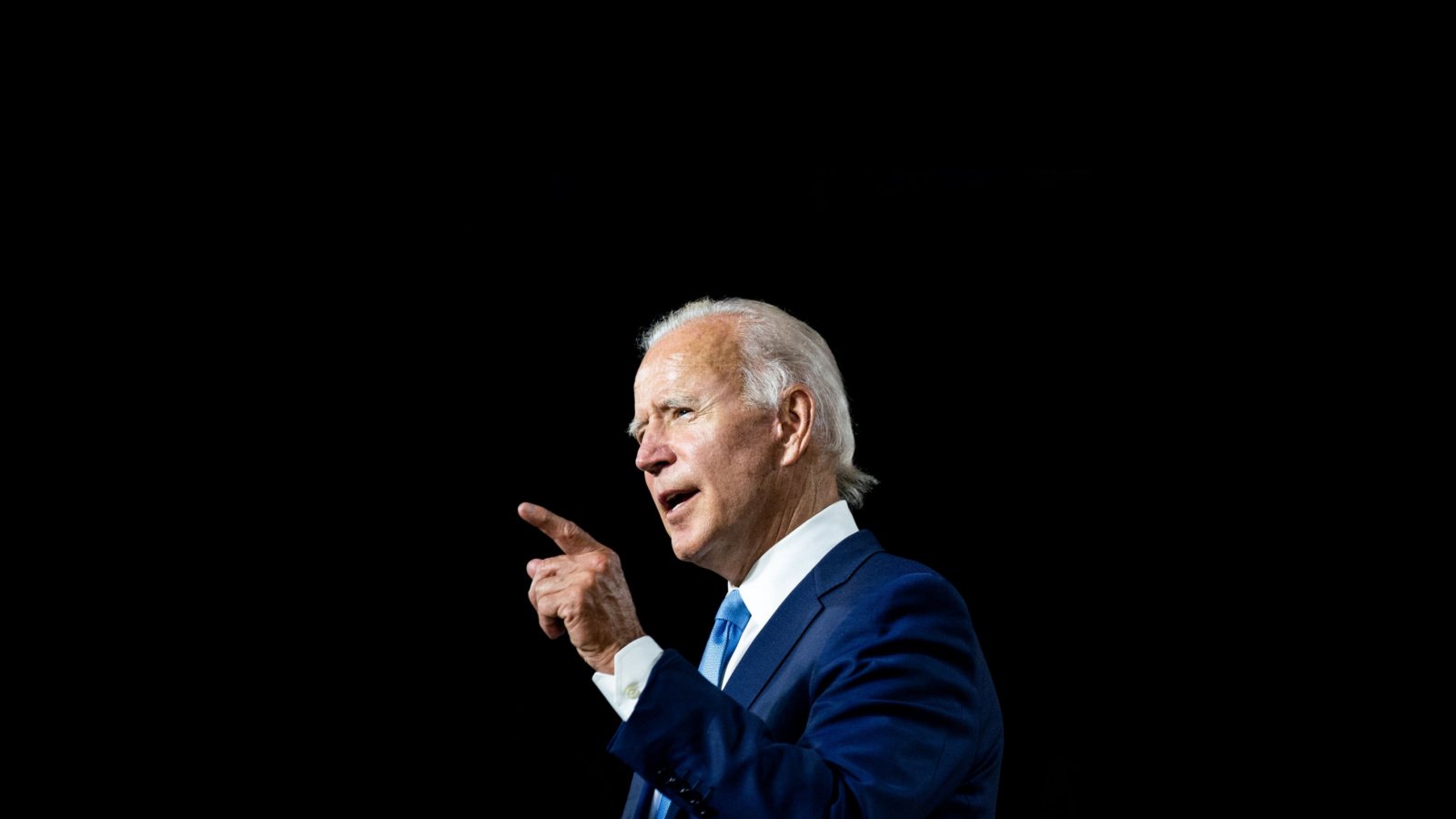

While the aura around so-called Joe Biden stocks is at best ambiguous because of the uncertainty surrounding any election cycle, if you have high conviction that the incumbent president can win a second term, there are certain ideas that stand out.

Fundamentally, Democrats support progress – progress in values, principles and protocols. On the other hand, Republicans generally maintain the status quo, which involves adherence to traditions and homage to ideological heritage. Of course, the concept of election stocks is tricky because of significant overlap. For example, companies tied to physical infrastructure can do well under either a Biden or Trump administration.

However, because Democrats value kinesis over stasis, most Joe Biden stocks will organically incorporate forward-thinking concepts. Obviously, clean-emissions-related measures stand out. But so do enterprises that foster equity and diversity in education and advanced technical fields. Granted, companies are already moving in that direction anyways. Still, governmental tailwinds wouldn’t hurt.

Finally, let’s not forget that election stocks are also about responding to consumer behaviors. If Biden wins, roughly half the country would be unpleased. And that may yield counterintuitive results.

What am I talking about exactly? Read this list of Joe Biden stocks to find out!

Vulcan Materials (VMC)

Presumably, if the current president wins a second term, one of the best Joe Biden stocks to buy would likely be Vulcan Materials (NYSE:VMC). That’s for obvious reasons. As the nation’s largest producer of construction aggregates – mainly crushed stone, sand and gravel – it will likely play a vital role in any infrastructure development policies. Call it Build Back Better, part two.

Of course, for Vulcan to have the best chance of upside, the Democrats need to win down ballot as well. That’s far from a given based on the contentious nature of American politics at the moment. However, Vulcan represents one of the safer election stocks because no president can afford to give up on infrastructure. If Trump wins, he will need to make America great again.

That has Vulcan Materials written all over it.

Looking ahead, analysts rate VMC a consensus strong buy with a $253.88 average price target over the next 12 months. Further, the high-side target lands at $279, implying solid, reliable growth potential.

Microsoft (MSFT)

Should 46 get four more years, Microsoft (NASDAQ:MSFT) needs to be on your short list of Joe Biden stocks to buy. It really hits all the right notes that the administration and Democrats in general seek. Primarily, Microsoft is a technology giant and that’s exactly what the Biden-Harris administration is seeking to bolster.

The White House isn’t just interested in forwarding science, technology, engineering and math (STEM) education but also eliminating barriers so that all students can benefit. Not surprisingly, Microsoft has stepped up big time, launching various global diversity and inclusion initiatives. As well, the company seeks to cultivate girls’ growth in STEM subjects. These are all strong left-leaning talking points, making MSFT a compelling example of election stocks to consider.

If that wasn’t enough, the company also laid out aggressive climate goals, such as being carbon negative by 2030. And by 2050, it will remove its historical emissions since its founding in 1975. Oh yeah – analysts love MSFT because it just keeps winning. Look for shares to hit $469.45 within the next 12 months.

Unilever (UL)

A British multinational consumer goods company, Unilever (NYSE:UL) makes for an excellent candidate for election stocks. Why? Because no matter what happens come November, people will still buy baby food, beauty products, bottled water, breakfast cereals and cleaning agents, among many other necessary products. Indeed, if Biden doesn’t pull it off, there could be a huge spike in ice cream sales as Democrats turn to coping mechanisms.

So, Unilever should win irrespective of the results. However, an argument could be made that UL stock could win bigger if Biden receives a second term. During the worst of the Covid-19 crisis, the company stepped forward, acknowledging systemic inequities and seeking ways to even the playing field. As well, the company has made huge strides in terms of holistic sustainability. That includes gaining approval from the People for the Ethical Treatment of Animals (PETA).

Ultimately, then, 46 getting another four would be delightful for Unilever, making it one of the Joe Biden stocks. Also, since November, the company secured two analyst buying ratings.

UnitedHealth (UNH)

As a healthcare giant best known for its insurance products, UnitedHealth (NYSE:UNH) represents a viable example of election stocks. Bottom line, it really doesn’t matter who becomes POTUS. Healthcare is a necessity and that goes for Republicans and Democrats. Now, the political angle comes in the form of the challenges (or opportunities) a company like UnitedHealth may face depending on the November results.

If we’re going to talk about Joe Biden stocks, then UNH should be on your radar. Assuming that Biden wins reelection, the company could potentially benefit from various healthcare expansion initiatives and reform. For example, it could see upside opportunities with the possible expansion of Medicare or Medicaid. As well, regulatory changes may materialize that could favor managed care organizations.

Certainly, UNH isn’t a name that will make you rich. Over the past year, it’s only printing a modest return. However, with analysts rating shares a consensus strong buy with a $593.13 price target, it’s a good idea to have in your portfolio.

Smith & Wesson Brands (SWBI)

Okay, you’re going to have to bear with me here. When we discuss Joe Biden stocks, we shouldn’t just focus on the companies the president would appreciate. Instead, we should discuss enterprises that could perform well because he’s in office. If there’s any an ironic stock to be had during this election cycle, it would be Smith & Wesson Brands (NASDAQ:SWBI).

Let’s think about this now. If Biden were to pull off a victory and he helped down-ballot Democrats to win big, SWBI should jump higher. How come? Simple – people would rush to the gun store to pick up firearms they fear may become illegal. Plus, with the nation grappling with so much firearms-related violence, a liberal or progressive administration can’t punt the issue.

No, Democrats would have to come down hard on the second amendment. And that means SWBI should fly higher, contradicting its modest moderate buy target. However, it’s also one of the riskiest election stocks. If Trump wins, the subsequent conservative relief may cool firearm sales.

Enphase Energy (ENPH)

Moving into the higher-risk component of Joe Biden stocks to buy, Enphase Energy (NASDAQ:ENPH) should be earmarked for speculation. During the final days of 2022, ENPH peaked then collapsed and then collapsed some more. Indeed, its trailing 52-week loss will raise more than a few eyebrows. And if we’re being blunt, we’re not off to a great start in 2024.

In fairness, Enphase will need certain elements of the economy and monetary policy to move in its favor. Specifically, the elevated inflation rate combined with onerous borrowing costs imposed devastation on Enphase’s business. As well, it impacted the underlying solar energy industry. With consumer sentiment deflated last year due to broader jitters, Enphase suffered a significant de-risking.

At the same time, if Biden wins, his administration will likely push various clean and renewable energy initiatives. Moreover, if the Democrats win alongside the president, that should be a huge bonus for ENPH. Analysts peg shares a consensus moderate buy with an average $127.50 price target.

Albemarle (ALB)

Currently, the electric vehicle market is suffering from turmoil so betting on a related enterprise might seem risky. However, if you really believe that 46 will get another crack at the White House, then Albemarle (NYSE:ALB) should be one of the Joe Biden stocks to buy. Yeah, the specialty chemicals firm has also suffered alongside the EV market. Indeed, ALB and the negative performance of Tesla (NASDAQ:TSLA) this year are almost identical.

However, at some point, you got to figure that EVs will work its way out of its funk. And while integration may be more difficult in certain parts of the country, powerhouse states like California – where the weather is much more temperate – should be a boon for the sector. Plus, if Biden wins, we could see more incentivization programs to push EV adoption.

As well, supporting Albemarle has a geopolitical connotation in that the U.S. will be competing with China in the EV space. So, while ALB is hitting every branch of the ugly tree, a Biden reelection could turn things around. Subsequently, analysts rate shares a moderate buy with a $152.89 price target.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.