U.S. stock markets are rising back again, but is it prudent to let loose bet on a risky play like GameStop (NYSE:GME) stock?

Despite deplorable fundamentals, video gamer retailer GameStop has somehow managed to be relevant. A single tweet or the slightest hint of an appearance on his YouTube channel by notable retail trader Keith Gill, also known as Roaring Kitty, can send GameStop’s stock soaring.

We’re in that time now. But these moments are few and far between, which makes GameStop stock a sell for me.

GameStop stock’s fluctuations have little to do with traditional market norms. The movements are more about social media-driven rallies spearheaded by investors like Gill. While some can reap the rewards, others might see a substantial loss in their investments. Predicting another surge in GameStop stock is challenging for me. Hence, GameStop is not for the faint-hearted and is best suited for retail traders looking for a quick entry and exit.

GameStop’s Stock Performance: A Three-Year Review

GameStop has been an incredibly volatile stock over the past decade, catapulting some to millionaire status while leaving others in financial ruin.

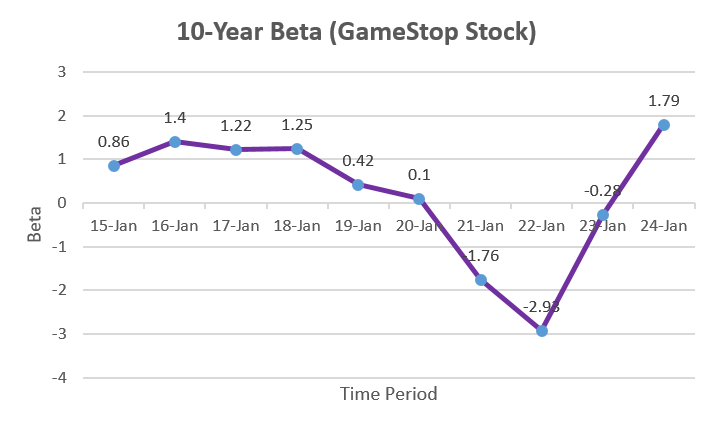

Perhaps the best way to assess GameStop stock’s sensitivity is to look at its beta values over the past decade.

The chart above highlights its reactive nature to the broader market and speculative trading over the past decade. From 2015 to 2018, the stock had a positive correlation with the market. But from 2018, its beta value was in free fall before bottoming out in 2022. Since then, it has been on an upward ascent and now stands at a 10-year peak at 1.79.

Naturally, these extreme shifts reflect GameStop’s transformation into a ‘meme’ stock, which is heavily influenced by social media trends and retail investor speculation. Moreover, this trend can be seen in its stock price performance over the past three years.

The chart above shows that GameStop stock has surged through several resistance levels and retraced to test multiple support levels. However, major rallies in GameStop stock occurred during the retail trading frenzy in early 2021 and mid-2024.

From January 8 to January 25, 2021, the stock shot up from $4.42 to $19.20, representing a 334.4% increase. Perhaps the most dramatic rally was from January 12 to January 27, 2021, with its price surging from $4.99 to $86.88, a 1641% jump. Earlier this year, from May 22 to June 6, 2024, it rose from $21.12 to $46.55, up 120.4%.

Financial Turbulence: The Uncertain Path Ahead for GameStop

GameStop is up against major challenges in the evolving retail landscape.

The company has traditionally relied on physical game sales. Yet in recent years, it’s been more GameStop’s Achilles heel as the gaming industry transitions to digital and streaming platforms. Naturally, it’s at a major competitive disadvantage compared to its rivals, with more powerful digital strategies.

Adding to its woes, GameStop’s eCommerce initiatives have faltered. Though it initially had lofty plans to reinvent itself as a digital-centric retailer, those have largely been abandoned. This strategic exit further hindered its ability to compete against companies with a stronger online presence.

There’s little to be optimistic about when looking at GameStop’s financials. Last year, the company saw its sales drop by 11% year-over-year (YOY) to $5.3 billion, closing the year with stores down from 4,413 to 4,169. The first-quarter (Q1) showed a deepening of its troubles, with sales plummeting to $881.8 million, marking a concerning 29% drop from the previous year. Moreover, the firm’s ongoing struggles are evident across all key segments, including hardware, software and collectibles, with no signs of imminent recovery. Hence, with store closures, economic pressures and sector-wide sales declines, it’s tough to anticipate a turnaround in GameStop stock.

Bottom-Line on GameStop stock

GameStop has been a stock market anomaly over the past few years but sprung back into relevancy this year. However, the latest iteration of the meme stock saga was short-lived, which poses serious questions over GameStop’s relevancy for even the retail trading crowd. Its sales have been declining rapidly, and expecting a fundamental turnaround is as daft as waiting for pigs to fly.

Thus, for GameStop, all eyes are on Roaring Kitty, who has been notably silent, to potentially ignite a rally. For serious investors, though, it’s best to stay on the sidelines.

On the date of publication, Muslim Farooque did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines

On the date of publication, the responsible editor did not have (either directly or indirectly) any positions in the securities mentioned in this article.