General Electric (NYSE:GE) stock closed May 15 at $5.49 per share, a 29-year low for the American multinational conglomerate. Not since December 1991 has the company recorded such a low share price. That was back when George H.W. Bush was still in office, and Father of the Bride was running in theaters.

It’s a tough pill to swallow for the management since the free fall has less to do with them and more to do with the novel coronavirus. Still, the markets are unforgiving, and investors will have to adapt accordingly.

For GE specifically, things are not looking great. Free cash flow is in the red, and the pandemic struck its Aviation division quite severely.

With all these negatives, it seems investors should look elsewhere for a safe investment. Pouring more capital in GE stock just doesn’t seem like a prudent strategy at the moment.

Aviation Revenues Are Dissipating

According to the latest report from the International Air Transport Association, air travel will lag pre-coronavirus forecasts for a minimum of five years. That’s a long time by any stretch, and it will likely affect GE’s most profitable segment — Aviation. Data shows that just one-third of the global jet fleet is in the air, a worrying statistic.

With the rest of the jets grounded, there will be less use of GE to service and manufacture engines. This translates to substantial dips in revenues, ones that GE could have lived without.

GE Is Bleeding Cash Flow

When GE reported its first-quarter earnings, a lot of analysts, including myself, were expecting cash flows to be positive. Now granted that companies are burning through cash fast due to Covid-19, we were still hoping for a healthier figure than -$2.2 billion. That belief was down to the substantial divestitures the company performed over the past few quarters.

In the year-ago period, cash flow was -$1.22 billion, so where did the company go wrong? It primarily has to with inventory, which stands at $15.5 billion in the latest quarter, up from $14.1 billion in the fourth quarter of 2019. You can expect this figure to climb further as clients cancel orders due to the pandemic.

On the bright side, the conglomerate will get $20 billion in proceeds from the sale of its biopharma business. This should bolster the company’s liquidity position and reduce debt. However, as we will get to later, the deal could be a long-term mistake.

Biopharma Sale Will Gut GE’s Health Care Business

It’s tough for us to say what was the best route to go for the business, concerning the sale of its Biopharma business. On the one hand, the company has a debt load of $85 billion that it would like to pare down. On the other side, it is disposing valuable income-producing assets to make a dent on that debt.

Take the example of GE Healthcare. The segment was second in terms of overall contributions to the business over the last couple of years, with almost $20 billion in revenue. A large chunk of that revenue was down to the company’s biopharma business. Initially, the business segment was supposed to be spun off, but that plan did not materialize.

Now that it has been sold to Danaher (NYSE:DHR), GE has foregone a very profitable segment for some much-needed cash. It makes me wonder whether the company could do the same with other lines of business in its health care offering.

GE Healthcare is vital in the fight against Covid-19. So, I would not be surprised if its components do not fetch a high price. But I hope that does not happen since it would not be suitable for the company over the longer term.

GE’s Could Be Heading For a Rating Downgrade

S&P Global Ratings recently revised its outlook on GE to “negative” from “stable.” The credit rating agency said it was concerned that the company’s exposure to Aviation would impact its deleveraging efforts.

S&P believes it will be tough for GE to decrease leverage to below 3.5x in 2021. Worryingly, GE’s BBB+ rating is three notches above “junk” category. The change in outlook means the company is in greater danger of a ratings downgrade down the line.

Aviation and Healthcare represented the majority of total segment profits, and both will not be contributing substantially to the bottom line moving forward. So, S&P’s observations are hardly surprising. However, any further downgrade could eliminate the chances of tapping bond markets for capital needs — a significant problem.

Industrials Won’t Save GE Stock

In case GE thought its industrial segment would save the company, it has another thing coming. The global economy is in recession, and industrial companies are among the hardest hit. The industrial businesses will also feel the pressure of negative headwinds and reduced consumer demand. As clients continue to retrench, GE will have to look at other segments for profits and sustainability.

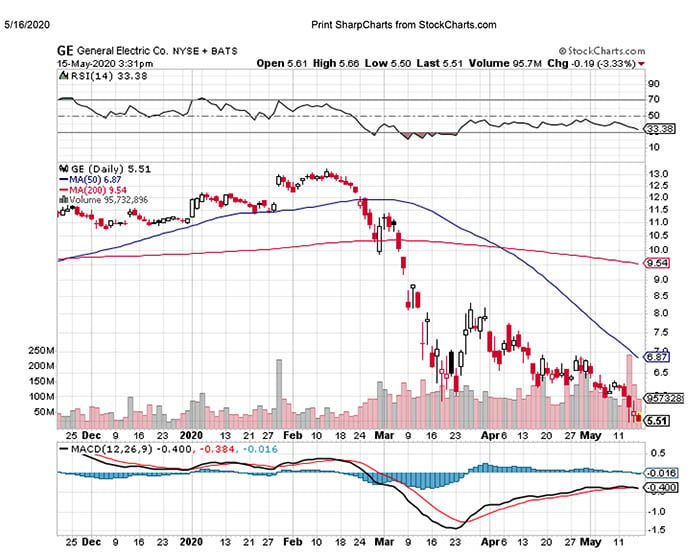

GE Stock Is Headed For a Breakdown

I am an optimist at heart, but GE finds itself between a rock and a hard place. In the first quarter, the company saw revenues decline by 24.8% from the year-ago period. Healthcare was the only segment that did not report a loss, and that’s understandable, considering Covid-19 and the importance of the health sector in these times.

Meanwhile, it’s up in the air when we’ll see Aviation return to numbers of normalcy. The company is forecasting a 25% permanent reduction in its workforce to account for the contraction in global demand.

In summary, GE is testing the patience of the most optimistic investor. I am calling for selling GE, but more importantly, I hope the company manages another Houdini act and survives this crisis.

GE stock has been here before. It lost more than 80% of its value after narrowly avoiding bankruptcy in 2016. Here’s hoping the company can do enough to scrape by and live to fight another day.

But things are looking bleak.

As of this writing, Faizan Farooque did not hold a position in any of the securities mentioned above.