Believe it or not, tech stocks are in a new bull market right now.

The tech-heavy Nasdaq-100 charged higher this past week, including a big rally on Friday after February inflation data came in much softer than expected.

This rally is nothing new. Tech stocks have been rallying all year long. Indeed, the Nasdaq popped more than 18% in the first quarter of 2023, marking one of its best quarterly performances ever.

The rally has been so big, in fact, that the Nasdaq is now up more than 20% from its December lows.

Now, by definition, a technical bear market starts when stocks drop 20% off recent highs. Meanwhile, technical bull markets begin when stocks rally 20% off recent lows.

Well, this past week, the Nasdaq did the latter.

Therefore, by definition, tech stocks have entered a new bull market for the first time since COVID emerged.

We strongly believe this technical new bull market is the “real deal,” not a head-fake. That’s mostly because recent strength in tech stocks is deeply rooted in favorable fundamentals.

That is, the fundamental factors in the global economy have been strongly shifting in favor of tech stock outperformance over the past few months. And they should keep shifting bullishly in the coming months, too.

Why?

Let’s get into it.

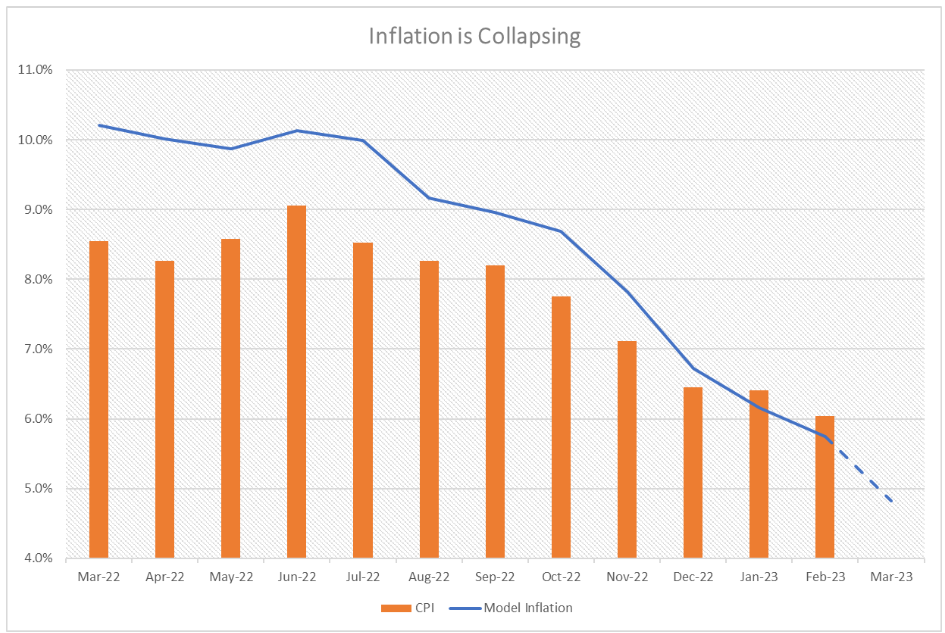

#1: Inflation Is Crashing

Red-hot inflation hurt stocks in 2022. But inflation is crashing in 2023. Consumer price inflation was running above 9% in mid-2022. Last month, it crashed to 5%. And leading indicators suggest that inflation will drop to 4% in March, 3% by the summer, and 2% by the fall. Inflation and falling stocks were the prevailing themes of 2022. But here in 2023, disinflation and rising stocks are the prevailing themes.

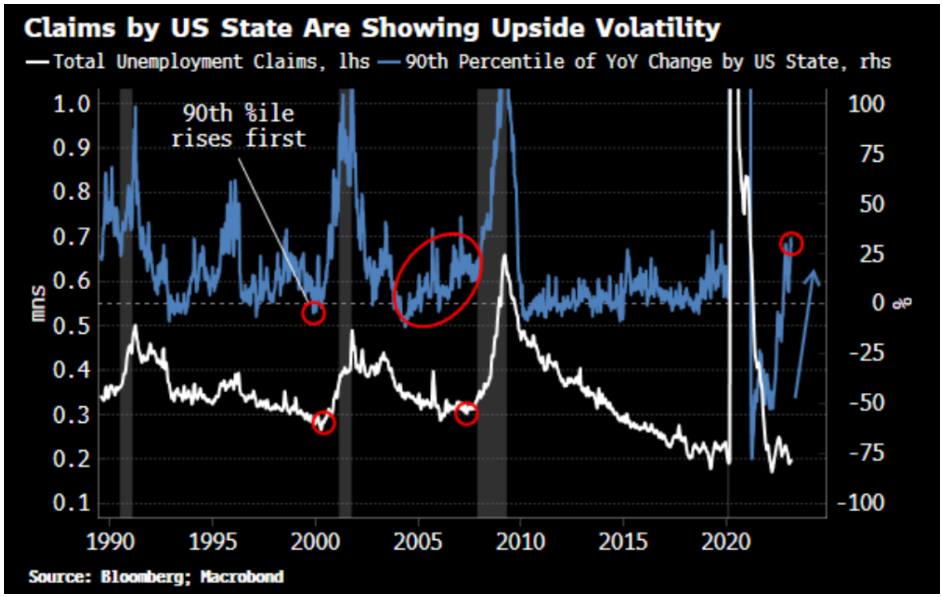

#2: The Labor Market Is Cracking

A stubbornly strong labor market in 2022 kept wage growth hot, which, in turn, kept the Federal Reserve on the offensive in its fight against inflation. That dynamic, of course, hurt stocks last year. But the labor market is finally starting to crack. Sure, unemployment rates remain low, and so do weekly jobless claims. But leading indicators of labor market strength have substantially weakened over the past two months, implying that the stubbornly hot labor market is finally cooling. For example, jobless claims in the most economically-sensitive states are soaring right now. And corporate layoff announcements are, too. Both tend to be leading indicators of overall labor market strength. With the labor market finally cracking, the Fed can finally take its foot off the rate-hike pedal. That should materially boost stocks. And since growth and tech have led recent rallies, tech stocks should fly even higher.

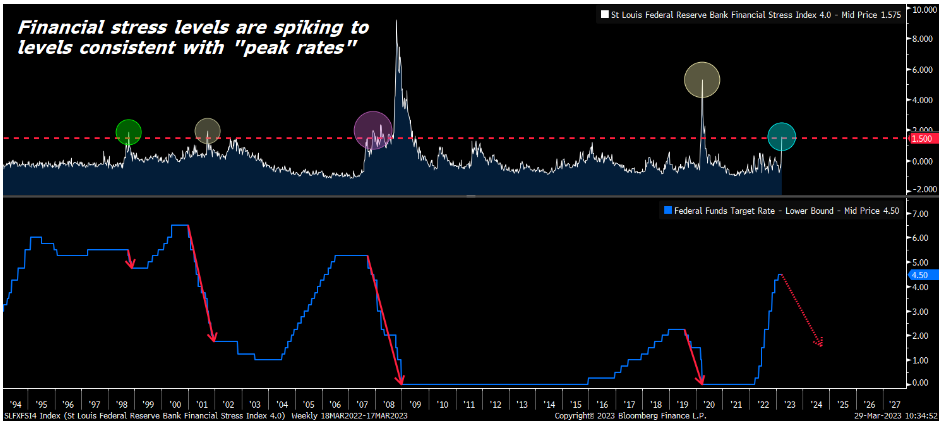

#3: Financial Stress Is Spiking

While the banking crisis appears to be largely contained (for now), it has put banks on edge. Credit spreads have expanded meaningfully over the past month, and now multiple measures of financial stress are spiking to unusually high and uncomfortable levels. Historically speaking, whenever financial stress measures spike to levels like this, the Fed always supports financial markets with either a rate pause or rate cuts. And stocks tend to follow that action with big rallies.

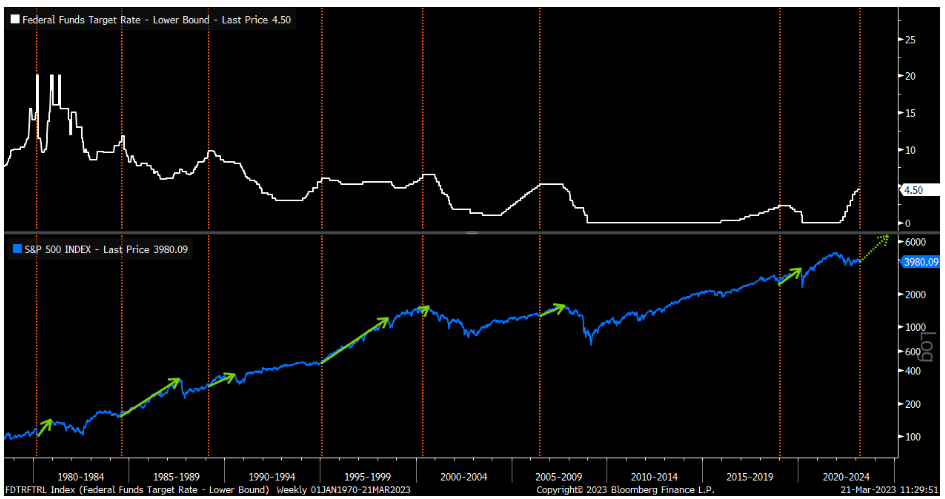

#4: A Fed Pause Is Inevitable

Given falling inflation trends, deteriorating labor market conditions, and spiking financial stress measures, it appears very likely ( perhaps even inevitable) that the Fed will pause its rate-hike campaign very soon. That’s exceptionally bullish for stocks because Fed pauses systematically spark stock market rallies. That is, over the past 40 years, every time the Fed has paused a rate-hike cycle, stocks rallied. Every single time with no exceptions. This time will not be different. A Fed pause in May or June will spark a big stock market rally that will likely spill into a new bull market.

#5: Earnings Are Impressively Resilient

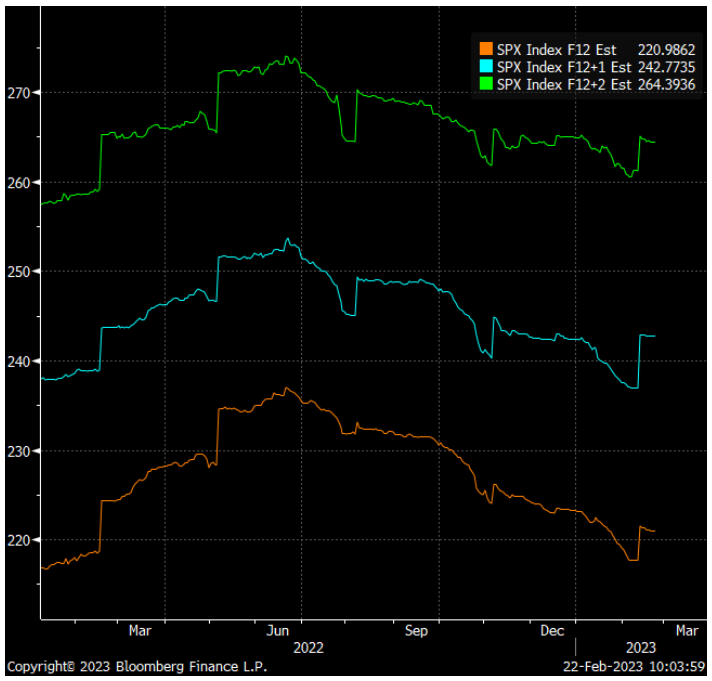

The bears said that corporate earnings would collapse in 2023 and that, as a result, stocks would crash. But that hasn’t happened. Corporate earnings have continued to grow in 2023, and forward estimates are bottoming, too. It looks like 2023 EPS estimates are stabilizing around $220. 2024 EPS estimates are stabilizing around $245, and 2025 EPS estimates are stabilizing around $265. This EPS estimate stabilization is a bullish signal for stocks going forward.

Considering all this bullish data, we’re confident that tech stocks have entered a new bull market. The Nasdaq has rallied more than 20% off its December lows. By definition, that means tech stocks are in a new bull market.

Does this bull market have legs? Is this the start of a three-,, five-,, or maybe even 10-year uptrend in stocks?

Well, given the favorable fundamental factors listed above, we think so.

If it is, then you should be getting greedy right now.

The Final Word on the Bull Market in Tech Stocks

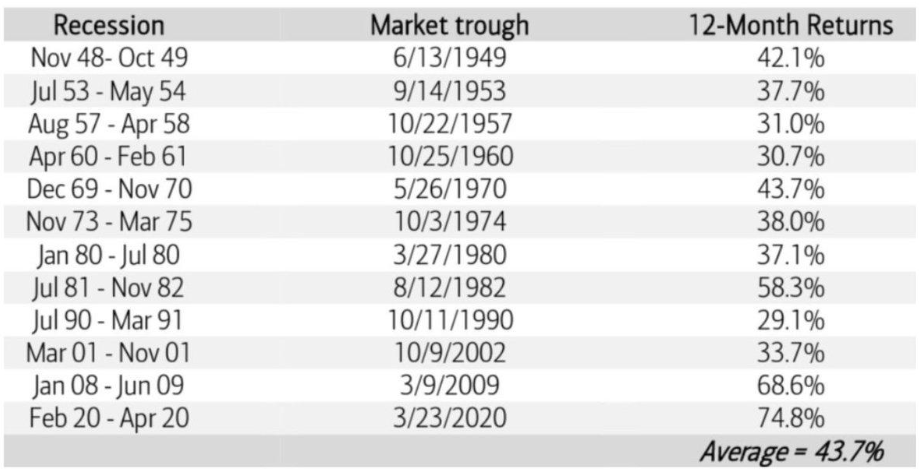

Whenever a bear market turns into a bull market – exactly what is happening right now – stocks tend to soar by nearly 45% over the next 12 months!

This is a huge money-making opportunity.

And as the chart above illustrates, huge money-making opportunities like this only emerge about once every 10 years.

That’s why we developed the perfect tool to capitalize on this huge opportunity.

It is a quantitative stock-picking system that we’ve developed and perfected over the past 12 months.

Its purpose? To find the most explosive stocks in the market – before they explode higher.

We use this system to find stocks that can rally 50% in a week, 100% in a month, even 500% in a year.

And already, even in the midst of a bear market, we’ve used this system to score several winners just like that.

This quant system is groundbreaking.

But most importantly, it is the perfect tool available at the perfect time.

And that’s why, this Wednesday at 4 p.m. EST, I’ll reveal the details of this breakthrough stock trading platform that’s already scoring readers some huge and fast returns.

I earnestly believe it could be your most powerful tool to scoring consistent huge winners in this new breakout bull market.

Reserve your seat to this presentation now!

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.