A worsening U.S. fiscal situation caught stock and bond investors off guard in the past week and now a round of approaching government auctions is about to provide a crucial test for Treasurys.

The question in the days ahead is whether risks to the demand for U.S. government debt are growing. If so, that could put upward pressure on Treasury yields, which would undermine the performance of stocks. However, if investors end up caring less about the fiscal situation than they do about the possibility of slowing economic growth and decelerating inflation, government debt’s safe-haven appeal could be reinforced, putting a limit on how high yields might go.

Concern about the deteriorating fiscal outlook was a factor behind the past week’s rise in long-term Treasury yields. Ten-

BX:TMUBMUSD10Y

and 30-year yields

BX:TMUBMUSD30Y

respectively jumped to 4.188% and 4.304% on Thursday, the highest levels since early November, as investors sold off long-term government debt — which took the shine off U.S. stocks. By Friday, though, a moderating pace of U.S. job creation for July sent yields into reverse, giving equities a temporary lift during the final trading session of the week.

At issue is the extent to which potential buyers of Treasurys may be deterred by Fitch Ratings’ Aug. 1 decision to cut the U.S. government’s top AAA rating, at a time when the government is about to unleash what Barclays rates strategists describe as a “tsunami” of supply. A total of $103 billion in 3-, 10-and 30-year Treasurys come up for sale between Tuesday and Thursday. In addition, a spate of Treasury bills are scheduled to be auctioned starting on Monday.

Gene Tannuzzo, global head of fixed income at Boston-based Columbia Threadneedle Investments, said that while he and his team still have room to add T-bills to the government money-market funds they oversee during the week ahead, they haven’t made up their minds about whether to buy more longer-dated maturities for their bond funds.

“While we are comfortable that the Fed is at or near the end of its rate hikes, there are a lot more questions about the durability of the economic recovery, the degree that inflation will remain low, and the risk premium that needs to be put in at the long end,” Tannuzzo said via phone.

Treasury’s $1 trillion third-quarter borrowing plans, along with some technical issues and the Bank of Japan’s decision to switch to a more flexible yield-curve control approach, might reduce demand for U.S. government debt, he said. Columbia Threadneedle managed $617 billion as of June.

“One can’t ignore the risk of an unruly rise in yields, but our view is that this is a low risk and what the Treasury auctions may produce instead is ‘indigestion,’ driven by poor technicals and low liquidity, Fitch’s downgrade, and the Bank of Japan action — and by the end of August, we should be past much of this,” he told MarketWatch.

Key Words: Warren Buffett dismisses Fitch downgrade: ‘There are some things people shouldn’t worry about’

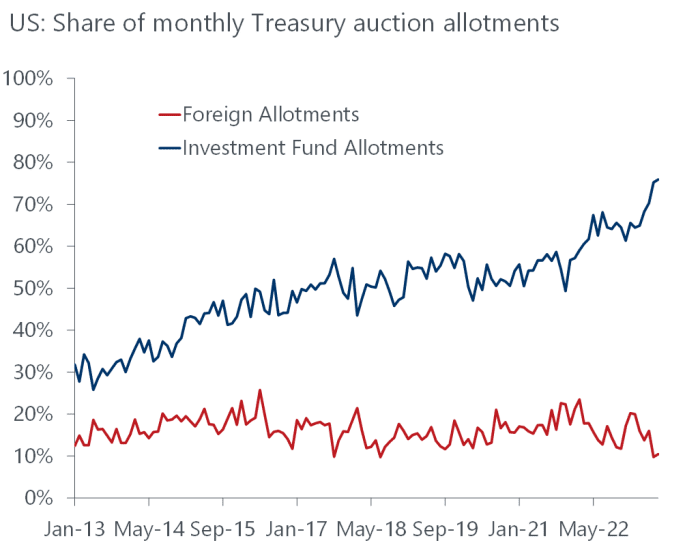

Risks to the demand for Treasurys may become obvious soon, given Tuesday-Thursday’s $103 billion in total sales of 3-, 10- and 30-year securities, according to analyst John Canavan of U.K.-based Oxford Economics. The main “question mark” for the market’s ability to absorb the increased Treasury issuance will be whether or not domestic investment funds continue to show interest, Canavan wrote in a note distributed on Friday.

Source: Oxford Economics.

“ ‘My suspicion is that with higher rates comes equally solid demand’ at upcoming auctions.”

Market players have had little difficulty absorbing Treasury coupon issuances in recent years because of flight-to-safety trades made after the U.S. onset of the Covid-19 pandemic in 2020. Now, however, increased auction sizes are being accompanied by still-elevated inflation, better-than-expected economic growth, and the possibility of more rate hikes by the Federal Reserve — which is likely to complicate the market’s ability to absorb the increased supply “without hiccups,” Canavan said.

On the flip side of the debate is John Flahive, head of fixed income at BNY Mellon Wealth Management in Boston, which managed $286 billion in assets as of June. He said equity markets will continue to be much more focused on economic developments and earnings. And as long as the latter of the two remains robust, stocks “can grind higher in a low-volatility environment,” Flahive said via phone.

Saying he does not expect his team to be a major participant in the Treasury auctions, Flahive said that the bond market’s reaction in the past week was “a little overdone” and “we always felt that there was a limited to how much yields could go up to reflect more government debt.”

“My suspicion is that with higher rates comes equally solid demand” at upcoming auctions, he said. “I’m still optimistic about rates going back down over time as the result of a slowing economy and decelerating inflation. We continue to like the bond market and see a better-than-even chance that yields go down as the economy continues to weaken in the quarters ahead.”

Friday’s reaction to July’s official jobs report, which showed the U.S. added a modest 187,000 new jobs, provided a breather from the past week’s run-up in Treasury yields.

On Friday, the 30-year Treasury yield fell 9 basis points to 4.214%, yet still ended with its biggest weekly gain since early February. The 10-year rate, which dropped 12.8 basis points to 4.06%, finished with a third straight week of advances.

Stocks fell Friday, leaving major indexes with weekly declines. The Dow Jones Industrial Average

DJIA

posted a 1.1% weekly fall, while the S&P 500

SPX

shed 2.3% and the Nasdaq Composite

COMP

retreated 2.9%. The soft start to August comes after a run of sharp gains for equities. The S&P 500 remains up 16.6% for the year to date.

The economic calendar for the week ahead includes U.S. inflation updates.

On Monday, June consumer-credit data is set to be released. Tuesday brings the NFIB’s small business optimism index, plus data on the U.S. trade balance and wholesale inventories. Then on Thursday, weekly initial jobless claims and the July consumer-price index are released. That’s followed on Friday by the producer-price index for last month and an August consumer-sentiment reading.

Meanwhile, portfolio manager and fixed-income analyst John Luke Tyner at Alabama-based Aptus Capital Advisors, which manages roughly $5 billion in assets, said he plans to follow the Treasury auctions, but doesn’t usually participate in them.

“One of the biggest trends we’ve seen is the continued increase in the issuance amounts from Treasury. Whatever we are budgeting for is never enough, which justifies the Fitch downgrade,” Tyner said via phone. “It’s tough to say people aren’t going to buy U.S. debt, but you’ve got to entice them to buy duration and take the risk.

“The U.S. is not an emerging market, but ultimately we are going to see the market rate that participants require be higher, with a notable uptick in term premia,” he said. “What we could see in the face of all this issuance is a grind up in yields on an auction-by-auction basis. If I look at the technicals, a 4.9%-5% yield on the 10-year note seems in the cards,” and “it will be difficult for stocks to hold or expand from full valuations as rates run up.”